The Importance of Lifetime ISA for Saving and Home Ownership

Introduction to Lifetime ISA

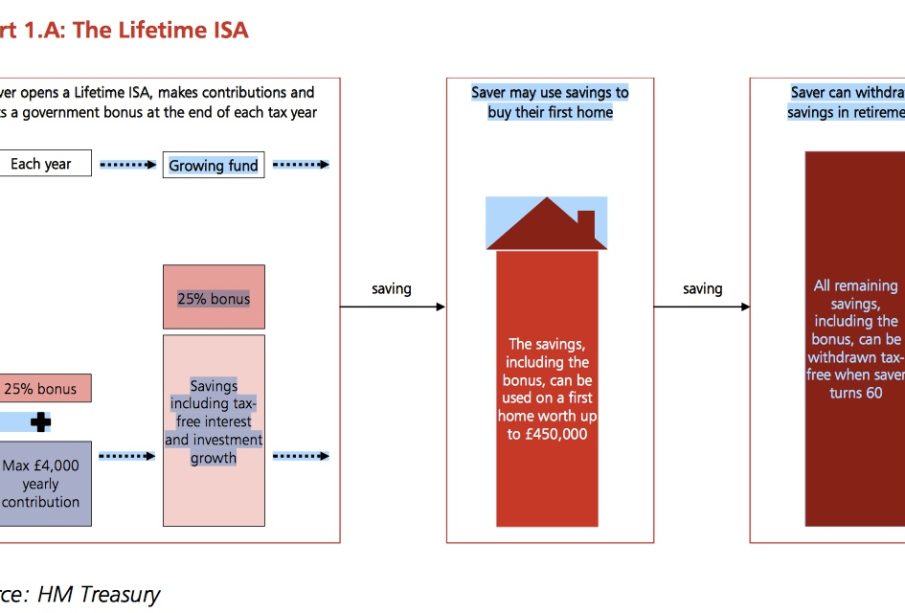

The Lifetime Individual Savings Account (ISA) is a vital savings scheme introduced by the UK government to aid individuals in saving for their first home or retirement. Launched in 2017, this initiative is particularly important for young people who may find it challenging to save for a property deposit. The Lifetime ISA not only incentivises saving but also supports long-term financial stability through government bonuses.

What is a Lifetime ISA?

A Lifetime ISA allows individuals aged between 18 and 39 to save up to £4,000 each tax year, with the government adding a bonus of 25% on contributions. This means that for every £1 saved, the government contributes an additional 25p, effectively boosting the value of savings. The total maximum bonus available, which can be up to £1,000 per year, underscores the importance of this saving vehicle for first-time buyers.

Eligibility and Usage

To be eligible for a Lifetime ISA, individuals must be aged between 18 and 39 at the time of opening the account. The funds within the ISA can be withdrawn without penalty for the purchase of a first home worth up to £450,000, or upon reaching the age of 60 for retirement use. However, withdrawing funds for purposes outside these parameters incurs penalties, which may deter individuals from using their savings prematurely.

Current Trends and Usage Statistics

According to recent statistics, the uptake of Lifetime ISAs has been encouraging, with over 500,000 accounts opened since its launch. The recent figures released by HMRC indicate that in the 2021-2022 tax year alone, more than £500 million was contributed to Lifetime ISAs. This trend suggests that more individuals are recognising the value of structured saving as they navigate the challenges of home ownership in today’s economy.

Conclusion and Future Implications

As housing prices continue to rise and economic uncertainties loom, the Lifetime ISA presents a critical pathway for first-time buyers in the UK. It not only motivates young people to save but also provides beneficial support through government contributions. Understanding the ins and outs of this scheme is indispensable for those looking to secure their financial future and navigate the increasingly challenging housing market.

In conclusion, as awareness of Lifetime ISAs grows, it is expected that more individuals will take advantage of this saving scheme. Financial literacy regarding the benefits of such accounts will be crucial, calling for increased referral resources and support across communities. The Lifetime ISA will continue to play an essential role in shaping the saving behaviours of the younger generation, aiding them on their journey to home ownership and financial independence.