The Importance of Child Trust Funds in the UK

Introduction to Child Trust Funds

The Child Trust Fund (CTF) is a long-term savings account designed to give children a financial head start in life. Launched by the UK government in 2005, CTFs were aimed at promoting saving among families and enhancing financial literacy for the younger generation. With the recent economic challenges and rising costs of living, understanding the importance of such funds becomes even more vital for the future financial wellbeing of children.

Key Features of Child Trust Funds

Child Trust Funds were established to ensure young people could benefit from a financial boost when they reached 18 years of age. The government initially provided a voucher to parents when a child was born, which could be used to open a trust fund with various financial providers. Since then, the scheme has undergone changes, but its legacy continues to influence saving behaviours today.

The funds are designed to encourage long-term savings, with parents and family members allowed to make extra contributions, capped at £4,368 per year (as of 2023). Upon reaching maturity at age 18, the child can access the funds, which can amount to substantial sums depending on contribution levels and investment performance.

Recent Developments and Impact

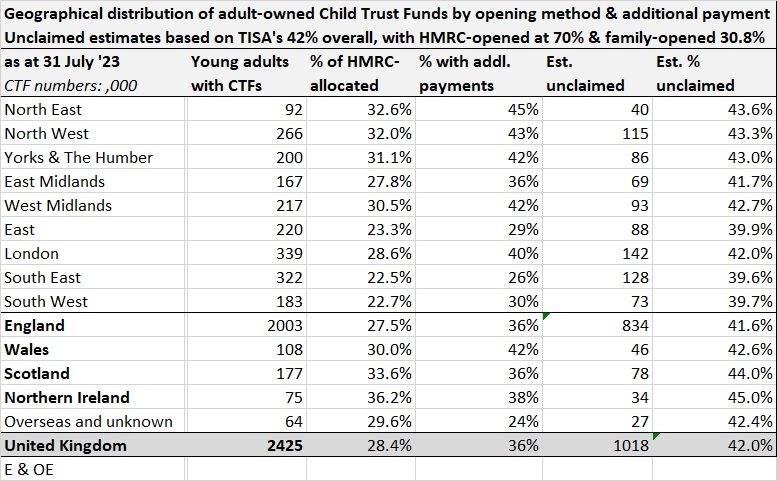

Recent reports indicate a resurgence of interest in Child Trust Funds as families grapple with the financial implications of inflation and the cost of education. According to HM Revenue and Customs, as of April 2022, there were 6.3 million Child Trust Funds in the UK, now worth an estimated £9 billion combined.

The Role of Child Trust Funds in Financial Education

CTFs play a crucial role in promoting financial literacy among young people. By having direct involvement in their savings from an early age, children can learn the significance of budgeting, saving, and investing. Additionally, the funds can serve as a means for young adults to finance further education, start a business, or make significant purchases, exemplifying the opportunity created through smart financial planning.

Conclusion: The Future of Child Trust Funds

As the UK moves toward increasing financial awareness among younger generations, the relevance of Child Trust Funds remains strong. While the government ceased the initiative in 2011, its ongoing impact is felt as families continue to benefit from the early investments made into their children’s futures. Looking ahead, there are calls for similar initiatives, which could enhance support for families and improve the financial landscape for future generations.