The Implications of the Bank of England Base Rate Changes

Introduction

The Bank of England base rate is a critical element of the UK’s economic landscape, influencing borrowing costs, savings rates, and overall economic growth. As the UK grapples with the aftermath of economic fluctuations exacerbated by global events, understanding movements in the base rate becomes increasingly vital for consumers and businesses alike.

Recent Developments

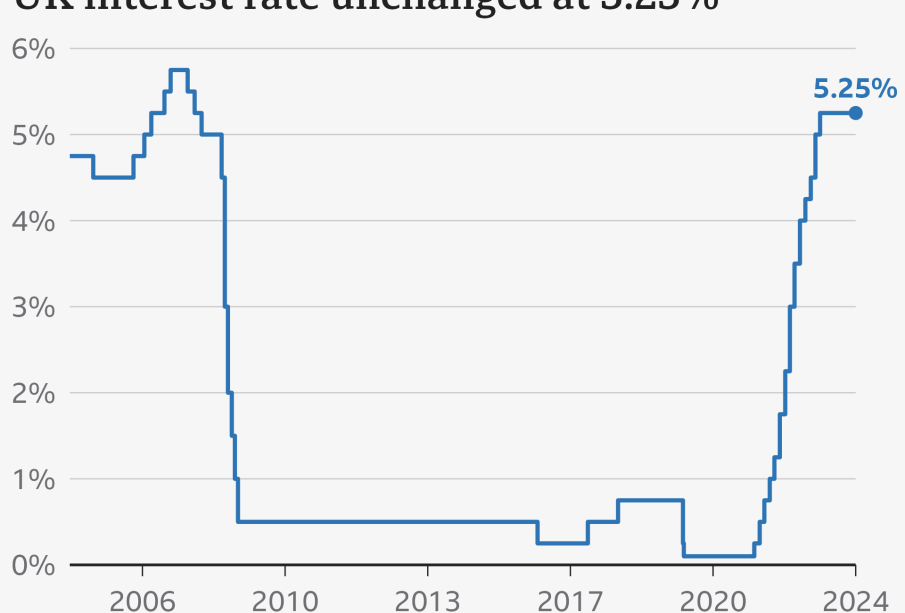

On 5th October 2023, the Bank of England announced a decision to hold the base rate at 5.25%, following an upward trend initiated in late 2021 in response to rising inflation. The decision comes as inflation rates, currently at 6.7%, show signs of moderation, though they remain above the Bank’s target of 2%. The base rate has been a tool for combating inflation, and with the cost of living crisis affecting many households, the Bank’s policies are closely scrutinised by economists.

Effects on the Economy

Maintaining the base rate at 5.25% aims to stabilise the economy while providing a cautious approach towards reducing inflation. This rate significantly influences mortgage rates, personal loans, and business financing. As a result, many homeowners and prospective buyers are impacted, with higher borrowing costs steering some away from property purchasing. According to the recent figures from the Bank of England, mortgage approvals have dipped, reflecting this hesitance. It is estimated that a sustained high base rate could lead to prolonged affordability issues for first-time buyers, further complicating the housing market.

Future Outlook

The outlook remains complex. Economists anticipate that if inflation persists beyond expectations, further adjustments to the base rate could be necessary. In contrast, if inflation decreases more rapidly, the Bank might consider reducing the rate sooner than expected. According to the latest forecasts from financial analysts, there is a possibility that the base rate may not decrease significantly until at least the second quarter of 2024, depending on economic indicators.

Conclusion

The Bank of England’s base rate continues to play a pivotal role in shaping economic conditions in the UK. For consumers and businesses, understanding base rate fluctuations is essential for making informed financial decisions. As the Bank navigates the challenging landscape influenced by both domestic and global factors, the approach to the base rate will remain a focal point for economic analysts and the public alike. Close monitoring of these developments will be crucial as we move forward into an uncertain economic future.