The Impact of Current Interest Rate Trends on the Economy

Introduction

Interest rates play a crucial role in shaping economic activities across the globe. They influence borrowing, spending, and investment decisions, making them a key focus for policymakers, businesses, and consumers alike. As central banks navigate economic recovery post-pandemic, understanding the current trends in interest rates has never been more relevant.

Recent Developments in Interest Rates

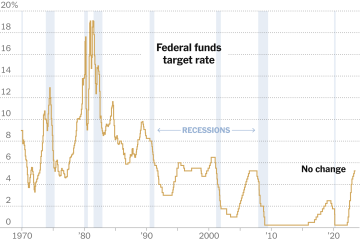

In the UK, the Bank of England has recently adjusted its base interest rate in response to ongoing economic fluctuations, primarily driven by inflation concerns and the broader impact of global supply chain disruptions. As of October 2023, the base rate stands at 5.25%, a significant increase since the low rates observed during the pandemic. These adjustments are part of the Bank’s strategy to ensure price stability and support sustainable economic growth.

The increase in interest rates is primarily aimed at curbing inflation, which has risen sharply due to a combination of factors including rising energy prices and post-pandemic demand surges. In response, the Bank of England anticipates that borrowing costs will rise, which could, in turn, lead to a slowdown in consumer spending and potentially dampen business investment.

The Impact on Consumers and Businesses

Higher interest rates generally mean increased costs for borrowing. For consumers, this translates into higher mortgage rates, which could affect housing affordability and dampen the housing market activity. A recent report indicated that mortgage applications have declined as potential buyers hold off due to increased borrowing costs.

For businesses, higher interest rates may lead to increased operational costs as loans become more expensive. This can restrict expansion plans, particularly for small to medium-sized enterprises (SMEs) that rely on financing for growth. Conversely, financial institutions may benefit as they adjust their lending rates, potentially increasing their profit margins.

Conclusion

The implications of current interest rate trends are significant for both consumers and businesses. As rates continue to rise, individuals may need to reassess their financial strategies, particularly regarding savings and debt management. Economists predict that the Bank of England may continue to raise interest rates in the near term to combat inflation, which will necessitate close monitoring by policymakers and stakeholders alike. Understanding these dynamics is essential for making informed financial decisions in an evolving economic landscape.