The Impact of Bill Browder on Global Finance and Anti-Corruption

Introduction

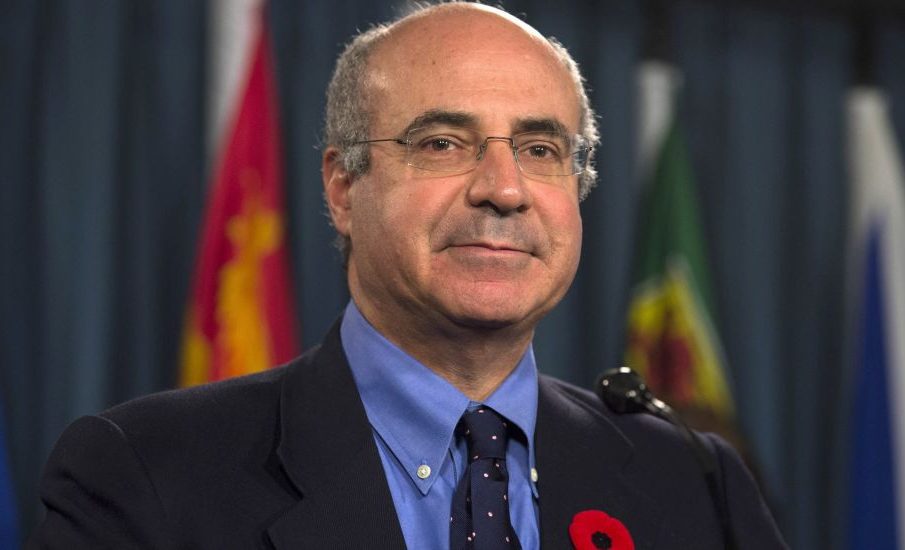

Bill Browder, a name synonymous with the fight against corruption and financial injustice, has made significant strides in raising awareness about human rights abuses within Russia. His journey from a hedge fund manager to an outspoken critic of the Kremlin exemplifies the intersection of finance and advocacy in today’s global landscape.

The Background of Bill Browder

Browder’s career began in the 1990s during the post-Soviet economic transition when he founded Hermitage Capital Management. His firm became one of the largest foreign investors in Russia, capitalising on opportunities during a tumultuous time. However, this trajectory changed dramatically following the death of his lawyer, Sergei Magnitsky, in a Russian prison in 2009. Magnitsky had uncovered a large-scale corruption scheme involving Russian government officials and was arrested as a result. Browder then shifted his focus from investment to activism, determined to seek justice for his late colleague.

Legislative Efforts and Global Campaigns

In response to Magnitsky’s death, Browder launched a campaign that led to the enactment of the Magnitsky Act in 2012 in the United States, which aimed to impose sanctions on Russian officials implicated in human rights abuses. This legislative action has sparked similar movements in other countries, demonstrating the increasing recognition of the need for accountability in governance and finance. The Magnitsky Act has opened up a global dialogue on the power of financial sanctions as a tool for human rights protection.

Current Developments

Recently, Browder has continued to lobby for international support against Russian oligarchs and officials, advocating for policies that would freeze their assets and ban them from entering the West. His ongoing efforts have a clear aim: to hold those responsible for corruption accountable and to support a more transparent financial system. The political climate surrounding Russia’s actions, especially amid the ongoing conflict in Ukraine, has amplified Browder’s message, raising further awareness among Western policymakers about the threats posed by corruption and authoritarian regimes.

Conclusion

Bill Browder’s journey is consequential not only for himself but also for the wider conversation about integrity in international finance. His ability to pivot from a successful hedge fund manager to an influential activist highlights the crucial role individuals can play in addressing systemic corruption. As the global community confronts the challenges presented by authoritarianism, Browder’s work serves as a reminder of the power of advocacy and the importance of vigilance in protecting human rights. Observers are keen to see how Browder’s initiatives will shape international policies and bolster efforts against corruption in the coming years.