The Future of Bitcoin: What to Expect by 2026

Introduction

Bitcoin, the pioneering cryptocurrency, has been a significant player in the financial landscape since its inception in 2009. As of 2023, Bitcoin continues to garner attention from investors, regulators, and the general public. Understanding Bitcoin’s trajectory towards 2026 is vital for individuals interested in the long-term implications of digital currencies on the economy and society.

Current Trends and Predictions

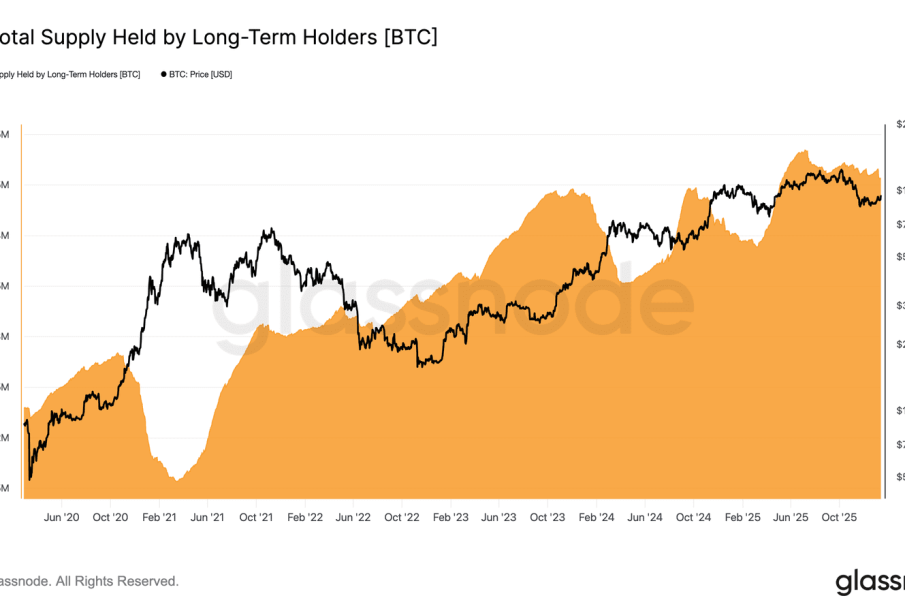

Bitcoin has demonstrated remarkable resilience and volatility over the past years. As of October 2023, the price of Bitcoin fluctuated around £25,000, showing signs of recovery after the downturn witnessed in 2022. Analysts from financial institutions are projecting substantial growth, with forecasts estimating Bitcoin could reach £100,000 or more by 2026, driven by increasing adoption and investment from institutional players.

One major trend influencing Bitcoin’s future is the ongoing integration of blockchain technology across various sectors, including finance, supply chain, and healthcare. Companies and governments are exploring innovative solutions to leverage Bitcoin for transactions, payments, and even as a reserve asset. Additionally, the rise of decentralized finance (DeFi) platforms has potentially increased Bitcoin’s utility beyond mere speculation, making it more attractive to a broader audience.

Regulatory Landscape

As Bitcoin grows, so does the regulatory scrutiny surrounding it. Governments worldwide are considering stricter regulations to mitigate risks associated with cryptocurrency, including fraud and market manipulation. By 2026, it is anticipated that clearer guidelines and frameworks will emerge, fostering a safer trading environment. Countries like the UK and the USA are leading this regulatory narrative, which could further solidify Bitcoin’s legitimacy as a financial asset.

Environmental Concerns

Another critical aspect for Bitcoin’s future is the discussion around its environmental impact due to the energy-intensive mining process. In response, some miners are transitioning toward renewable energy sources, and innovative solutions to decrease carbon footprints are being explored. By 2026, an expected shift towards sustainability in Bitcoin mining could enhance its public image and broaden acceptance.

Conclusion

The future of Bitcoin in 2026 remains uncertain, yet promising. Market forecasts predict significant price increases, influenced by expanding adoption and potential regulatory clarity. As the cryptocurrency ecosystem continues to evolve, stakeholders should remain informed of the developments regarding environmental practices and regulatory measures. Ultimately, Bitcoin’s journey to 2026 will significantly impact how societies view and interact with digital currencies.