The FTSE 100: A Key Indicator of UK Market Health

Introduction to the FTSE 100

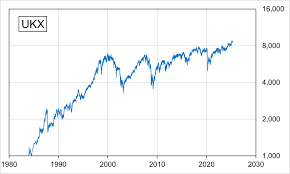

The FTSE 100, also known as the Financial Times Stock Exchange 100 Index, is a crucial gauge of the performance of the top 100 companies listed on the London Stock Exchange. It serves as a barometer for the economic prosperity of the United Kingdom, making it an essential index for investors and analysts alike. Understanding the dynamics of the FTSE 100 not only provides insights into stock market trends but also reflects broader economic conditions in the UK.

Current Trends in the FTSE 100

As of October 2023, the FTSE 100 has shown notable fluctuations influenced by various global factors, including inflation rates, energy prices, and international trade disruptions. After facing considerable volatility in the first half of the year, the index has bounced back, currently hovering around a significant psychological barrier of 7,500 points. Key drivers of this resurgence include a stabilising economic outlook post-Brexit and increased consumer spending, indicated by recent retail sales data.

Major Movers of the Index

Several companies dominate the FTSE 100, with sectors such as energy, finance, and healthcare playing critical roles in its movements. Noteworthy contributors include Shell, BP, and AstraZeneca, which have all benefitted from recent global market trends. For instance, with the recent surge in oil prices prompted by the OPEC+ production cuts, energy stocks have shown a robust performance, leading to overall gains in the index.

Implications for Investors

The implications of the FTSE 100’s performance for investors are significant. A rising FTSE 100 often correlates with a thriving economy, making it an attractive time for foreign investments and leading to higher asset valuations. However, analysts also caution about potential risks due to geopolitical uncertainties, such as ongoing tensions in Eastern Europe and economic policies that may arise from upcoming UK elections.

Conclusion: The Future of the FTSE 100

Looking ahead, market analysts expect that the FTSE 100 will continue to reflect both local and global events as it heads into 2024. The index remains a critical component in assessing the health of the UK’s economic landscape. For investors, staying informed about developments linked to the FTSE 100 can provide strategic guidance in portfolio management. Monitoring key economic indicators and understanding sector-specific trends will be essential for making well-informed investment decisions in the coming months.