The Evolution and Importance of Money Transfer Services

Introduction

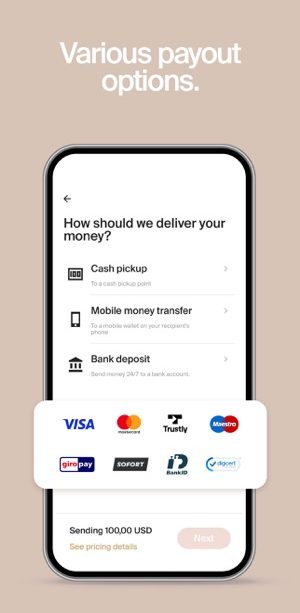

In today’s digital age, money transfer services have become an essential component of the global economy. With the rise of e-commerce and migration for work, the ability to transfer money quickly and securely across borders is more crucial than ever. These services facilitate not only personal remittances but also global trade and business transactions, making them a vital part of modern financial infrastructures.

The Current Landscape of Money Transfer Services

As of 2023, the global money transfer market has seen significant technological advancements and an increasing demand for faster and more user-friendly services. According to a report by Market Research Future, the money transfer industry is anticipated to reach USD 1.5 trillion by 2026, driven by the proliferation of digital wallets and online banking. Companies like PayPal, TransferWise (now Wise), and Revolut have made great strides in offering competitive exchange rates and lower fees, catering to a tech-savvy consumer base.

Recent Innovations

Recent developments include the integration of blockchain technology, which is revolutionising the way people conduct money transfers. Blockchain offers a transparent and secure system that eliminates intermediaries, reducing costs and transfer times significantly. For instance, transactions that once took days can now be completed in a matter of minutes, with added security against fraud. Furthermore, the growth of cryptocurrencies has created an alternative method of transferring money internationally, appealing to those looking for non-traditional methods.

Challenges and Regulatory Considerations

Despite these advancements, money transfer services also face several challenges. Regulatory compliance remains a significant concern, as different countries impose varying laws governing money transfers to prevent fraud and money laundering. The Financial Action Task Force (FATF) has continuously urged countries to adopt stricter regulations, which can complicate operations for money transfer companies. Moreover, the rise of cyber threats has heightened the need for enhanced security measures to protect consumer information.

Conclusion

In conclusion, the importance of money transfer services in today’s interconnected world cannot be overstated. As technology continues to evolve, the industry is set for further growth, promising faster, safer, and more efficient methods of transferring money. For consumers and businesses alike, understanding these services and the underlying technologies will be crucial for making informed financial decisions in the future. With ongoing innovations and increased regulation, the future of money transfers looks promising but will require adaptation and awareness from all participants in the financial ecosystem.