The European Central Bank: Current Issues and Future Initiatives

Introduction

The European Central Bank (ECB) plays a pivotal role in shaping monetary policy and economic stability within the Eurozone. Its decisions not only influence interest rates but also impact inflation, employment, and overall growth across member states. Understanding the current challenges faced by the ECB is paramount, especially in the context of post-pandemic recovery and rising inflation rates.

Current Economic Landscape

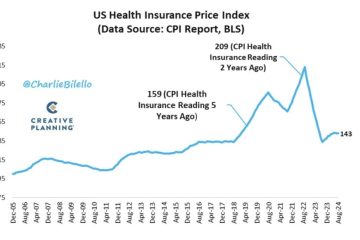

As of late 2023, the European economy is grappling with numerous challenges, including fluctuating inflation rates and energy crises exacerbated by geopolitical tensions. The ECB has recently announced its commitment to tackling inflation, which has soared in several member countries, reaching highs not experienced in decades. According to recent data, Eurozone inflation stood at a nearby 4.5% in September, prompting concerns over consumer purchasing power and economic stability.

Recent ECB Initiatives

In response to these challenges, the ECB has introduced several monetary measures aimed at curbing inflation and stabilising the economy. In October 2023, the central bank raised its key interest rate by 25 basis points, indicating a continuation of its hawkish monetary stance. ECB President Christine Lagarde highlighted in a recent press conference that sustaining price stability remains the bank’s utmost priority.

Additionally, the ECB has been actively engaging in discussions around quantitative easing and potential revisions to its asset purchase programme. The bank is monitoring the inflation trajectory closely, indicating that future policy adjustments will be dictated largely by inflationary pressures and growth indicators.

The Outlook Ahead

Forecasts suggest that while inflation may be moderating, external shocks such as energy prices and global supply chain disruptions could pose risks to economic recovery in the Eurozone. The ECB’s ability to navigate these turbulent waters is crucial not just for member states, but for the global economy as interconnected markets rely heavily on European stability.

In conclusion, the ECB stands at a crossroads as it balances the need for inflation control with supporting growth amid uncertainty. Stakeholders, including investors and policymakers, must closely monitor the ECB’s initiatives and responses to ensure they align with recovery goals for the Eurozone. As the central bank continues to make data-driven decisions, understanding these dynamics will be key for anyone engaged with European markets.