The Crucial Role of Venture Capitalists in Today’s Economy

Introduction

In today’s rapidly evolving economic landscape, the role of venture capitalists has never been more critical. As essential players in the innovation ecosystem, venture capitalists provide the necessary funding to startups, enabling them to develop new technologies, create jobs, and stimulate economic growth. This article examines the importance of venture capitalists, recent trends in their investment strategies, and the implications for the wider economy.

The Importance of Venture Capitalists

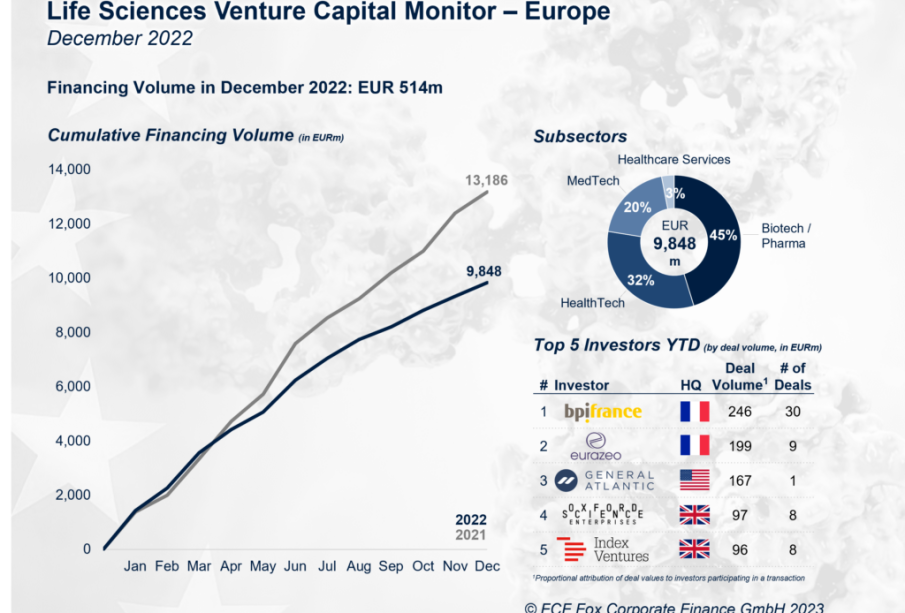

Venture capitalists are investors who specialise in funding startups and small businesses that exhibit high growth potential in exchange for equity or convertible debt. Their contributions are particularly crucial in sectors like technology, healthcare, and renewable energy, where the financial risks are higher, but the rewards can be substantial. Between 2020 and 2023, venture capital investment in Europe alone surged to over €90 billion, reflecting their growing influence and the rising number of entrepreneurs seeking capital to bring their ideas to market.

Current Trends in Venture Capital Investment

As of late 2023, the venture capital landscape is witnessing notable trends. Firstly, there is a clear shift towards sustainable and impact investing. Venture capitalists are increasingly prioritising companies that demonstrate social and environmental benefits alongside profitability. This shift is corroborated by a report from PitchBook, which indicates that investments in clean tech startups have increased by nearly 30% over the past year.

Additionally, there is a notable increase in the participation of female venture capitalists and diverse investment firms. Recent data suggests that firms led by women have outperformed their all-male counterparts, leading to a gradual, albeit necessary, diversification within a historically male-dominated industry. This trend is significant, as it promotes equity in funding and enhances innovation by incorporating a wider range of perspectives.

Challenges Facing Venture Capitalists

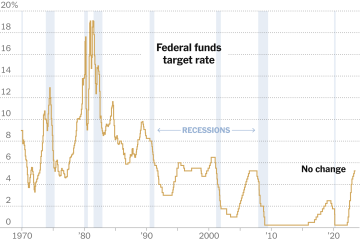

Despite their crucial role, venture capitalists face numerous challenges. The post-COVID economic climate has resulted in increased scrutiny of investment strategies, with many firms adopting a more cautious approach to funding. Furthermore, with rising interest rates and economic uncertainty, startups are finding it more challenging to secure funding without a robust business model. A report by the National Venture Capital Association indicates that venture capital investments fell by around 25% in the second quarter of 2023, underscoring the hurdles faced by investors and entrepreneurs alike.

Conclusion

In conclusion, venture capitalists remain a fundamental component of economic development and innovation. Their investments fuel the growth of new technologies and businesses, which in turn stimulate job creation and economic resilience. As the landscape evolves, the emphasis on sustainability and diversity within venture capital firms could result in a more robust and dynamic market. Observing these trends and challenges will be crucial for entrepreneurs looking to navigate the complexities of securing investment in this fragmented environment. For readers interested in the intersection of finance and innovation, understanding the role of venture capitalists provides valuable insights into the future of our economy.