Tesla Stock: Current Analysis and Future Predictions

Introduction

Tesla stock has become one of the most closely watched securities in the stock market today. As a leader in electric vehicles and sustainable energy solutions, Tesla maintains a significant influence on both investor sentiment and the automotive industry as a whole. With increasing interest from retail investors and institutional players alike, examining the current performance and potential future trends of Tesla’s stock is crucial for anyone looking to make informed investment decisions.

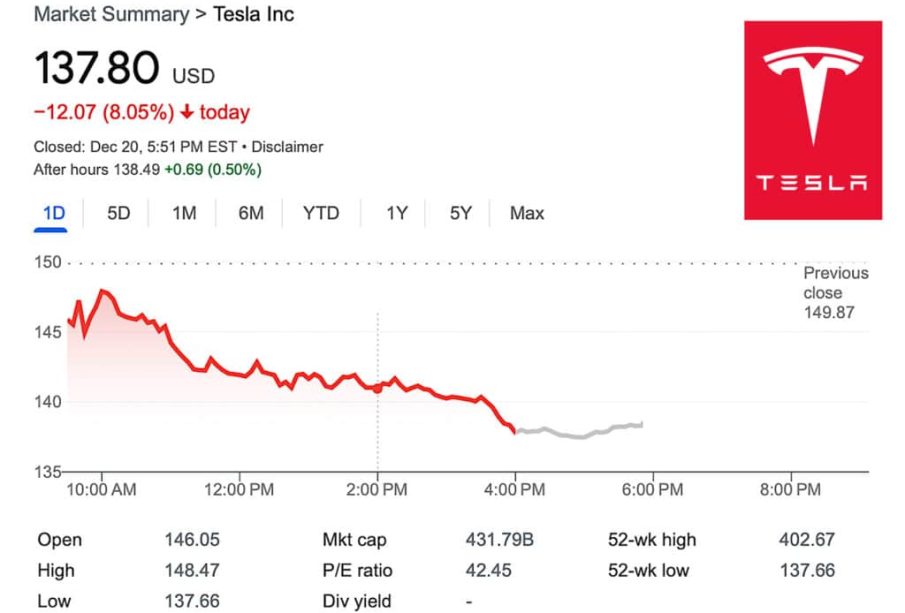

Current Market Performance

As of late October 2023, Tesla’s stock price has shown considerable volatility, reflecting broader market sentiment and company-specific developments. Recently, Tesla shares have experienced fluctuations between $230 and $250, influenced by factors including quarterly earnings reports, supply chain challenges, and macroeconomic conditions such as interest rate hikes and inflation concerns. Analysts have noted that while Tesla remains a frontrunner in the electric vehicle market, challenges such as increased competition from traditional automakers and new entrants like Rivian and Lucid Motors are increasingly impacting its market share and stock performance.

Key Developments

In the past quarter, Tesla reported a year-on-year increase in production volumes but faced challenges with delivery timelines and customer demand due to rising prices of raw materials. Additionally, Elon Musk’s decisions regarding pricing strategies have continuously influenced stock prices both positively and negatively. The introduction of more affordable vehicle models aimed at reaching a broader customer base has sparked interest, however, some analysts express caution regarding its impact on profit margins.

Another significant factor influencing Tesla stock is its expansion into international markets. Recent openings of Gigafactories in Berlin and Shanghai have fostered growth opportunities, allowing quicker response times to local demand. This expansion has resulted in increased revenue but also requires careful management to navigate regional regulations and production limits.

Future Predictions

Looking forward, analysts are cautiously optimistic about Tesla’s growth trajectory. While current market conditions pose risks, many believe that Tesla’s innovative approach and strong brand loyalty will help mitigate these challenges. Forecasts indicate that Tesla stock may outperform the market as new vehicle models roll out and as the company continues to push for advancements in autonomous driving and energy storage solutions.

Conclusion

In conclusion, Tesla’s stock remains a focal point for investors, reflecting broader trends in technology and sustainability. As the company navigates challenges and opportunities, staying informed about its market strategies and industry developments can provide valuable insights. Whether one is an existing investor or considering entry into the Tesla investment landscape, understanding the intricate dynamics at play will be key to making sound investment choices in the coming months.