Recent Trends in the Dow Jones Industrial Average

Introduction

The Dow Jones Industrial Average (DJIA) is a key indicator of the overall health of the United States stock market and the economy. As one of the oldest and most widely recognised stock market indices, the DJIA tracks 30 large publicly owned companies. Recent fluctuations in this index have garnered significant attention from investors and economists alike, highlighting its importance in understanding market trends.

Current Events and Recent Trends

As of late October 2023, the Dow Jones Industrial Average has experienced notable volatility, influenced by various factors such as interest rate changes, inflation data, and corporate earnings reports. In the past month, the index reached a peak of over 36,000 points before retracting slightly, closing at approximately 35,500 points. This decline came amidst rising inflation concerns and the Federal Reserve’s continued tightening of monetary policy.

Analysts have observed that the tech sector has been particularly influential in driving the index’s movements. Companies such as Apple and Microsoft continue to show strong earnings, contributing positively to the DJIA. However, sectors like energy and consumer goods have faced challenges, affecting the overall performance of the index.

Implications for Investors

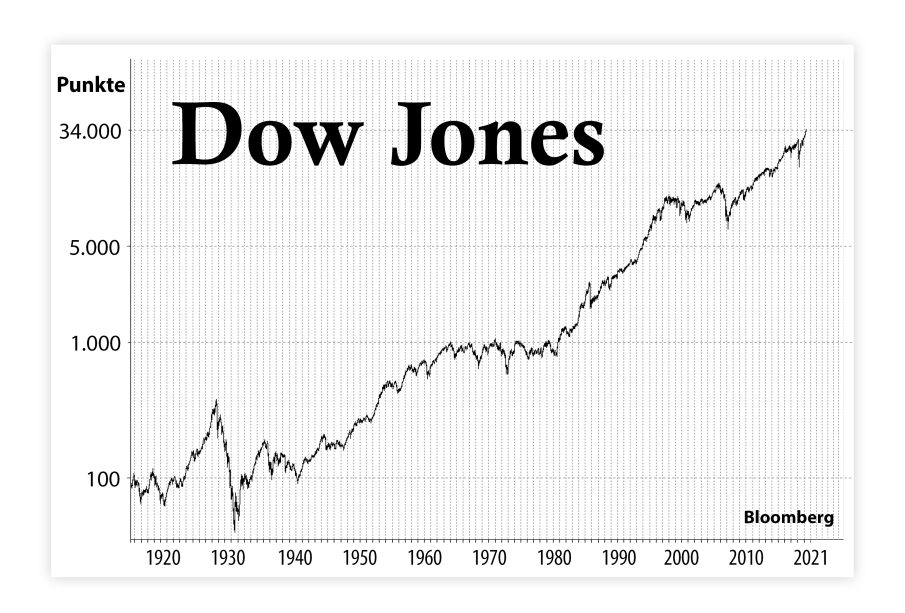

The fluctuations of the Dow Jones Industrial Average underscore the need for investors to remain cautious and informed. Analysts recommend diversifying portfolios to mitigate risks associated with volatility in the stock market. Historical data suggests that while short-term fluctuations can be unsettling, the DJIA has generally trended upwards over the long term, making it an essential component for many investment strategies.

Conclusion

In conclusion, the Dow Jones Industrial Average remains a pivotal gauge of market performance, reflecting the economic landscape in the United States. Investors should keep a close eye on upcoming economic indicators and corporate earnings reports, as these will likely influence the DJIA in the coming months. As the market continues to react to economic developments, understanding the dynamics of the DJIA will be crucial for making informed investment decisions.