Recent Trends in Ethereum Price: What You Need to Know

Introduction

The price of Ethereum, a leading cryptocurrency, has been a focal point for investors and traders alike due to its significant volatility and its implications for the broader market. Understanding the trends in Ethereum price is essential for those looking to engage in cryptocurrency investments or to keep abreast of financial innovations.

Current Events Surrounding Ethereum

As of October 2023, Ethereum’s price has been experiencing notable fluctuations, influenced by various global economic factors and internal developments within the Ethereum network. The Ethereum price recently peaked at approximately £1,800, attributed to increased interest following the successful implementation of the ‘Merge’ upgrade, which has transitioned the platform from a proof-of-work to a proof-of-stake consensus. This shift aims to enhance scalability and reduce energy consumption, attracting more institutional interest.

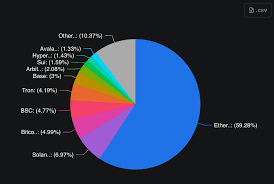

Moreover, a recent surge in DeFi (Decentralised Finance) projects using Ethereum’s blockchain has boosted demand for ETH tokens. According to data from CoinMarketCap, the Ethereum market cap has surged over the past few months, now holding a market dominance of around 18% within the cryptocurrency market, closely trailing Bitcoin.

Factors Influencing Ethereum Price

Several factors are contributing to the current trends in Ethereum price. These include:

- Regulatory Changes: As governments begin to establish clearer frameworks for cryptocurrency regulation, investors are cautiously optimistic, leading to increased market activity.

- Market Sentiment: The sentiment in the cryptocurrency market, driven by news cycles and major financial trends, remains highly influential on price movements.

- Technological Innovations: Continued developments in Ethereum’s infrastructure are crucial. The community is focusing on Layer 2 solutions that promise to alleviate scalability issues.

Conclusion

The price of Ethereum remains pivotal in the world of cryptocurrencies, serving as a bellwether for market movements. Analysts predict that if current trends continue, Ethereum could see further volatility, particularly as new regulatory updates emerge. For potential investors, staying informed about these factors is vital to making educated decisions. As the cryptocurrency landscape evolves, so too will the narratives around Ethereum’s price behaviour, making it an essential subject for both new and seasoned investors.