Recent Trends and Insights on JNJ Stock

Introduction

Johnson & Johnson (JNJ) stock remains a significant subject of interest for investors, given the company’s extensive history in healthcare products and pharmaceuticals. Recently, fluctuations in JNJ stock have been closely monitored, with many market analysts examining its performance amid economic uncertainties and industry developments. Understanding the current landscape of JNJ stock is crucial for current and prospective investors looking to navigate the evolving market.

Current Performance of JNJ Stock

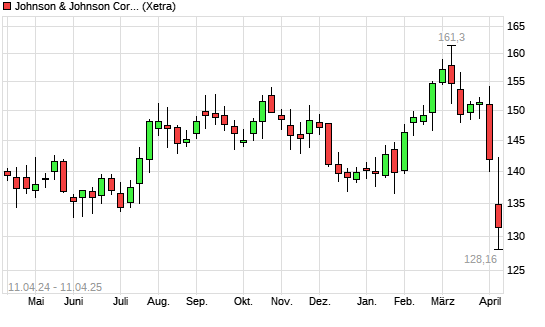

As of October 2023, JNJ stock has shown notable volatility, influenced by various factors including earnings reports, regulatory developments, and broader market trends. On October 10, 2023, JNJ’s shares closed at $156.73, reflecting a moderate increase of 1.5% from the previous week. This rise comes as analysts predict stable growth due to the company’s robust product pipeline and strategic acquisitions.

Key Factors Influencing JNJ Stock

One crucial element impacting JNJ stock is the company’s recent divestiture of its consumer health division, which was completed in late 2022. This strategic move aims to sharpen the focus on pharmaceutical and medical device sectors, anticipated to drive future growth and profitability. Furthermore, increasing demand for healthcare products, especially in the wake of the COVID-19 pandemic, has contributed positively to JNJ’s performance.

Additionally, the recent quarterly earnings report indicated that JNJ achieved earnings per share (EPS) of $2.76, surpassing analysts’ expectations. The company also raised its full-year revenue guidance, bolstering investor confidence and suggesting a stable outlook. However, potential market risks, such as litigation related to past product liabilities, continue to cast shadows on its long-term prospects.

Market Trends and Future Outlook

Market analysts forecast a cautiously optimistic outlook for JNJ stock moving into 2024. Analysts from several major investment firms have set price targets ranging from $165 to $175, indicating a potential upside. The growth is supported by planned innovations in key therapeutic areas like immunology, oncology, and neurology.

However, investors are advised to remain vigilant about potential challenges, such as fluctuations in raw material costs, changes in healthcare policies, and global economic conditions. Keeping abreast of these variables will be essential for steering investment decisions regarding JNJ stock.

Conclusion

In summary, JNJ stock offers a compelling prospect for investors, highlighting a blend of historical stability and future growth opportunities. While the stock’s recent performance has been positive, vigilant assessment of both market conditions and company developments will play a critical role in guiding investment strategies. As JNJ continues to adapt to the dynamic healthcare landscape, it remains on many investors’ watchlists as a key player in the sector.