Mortgage rates today: What borrowers should know (4 Feb 2026)

Introduction — why mortgage rates today matter

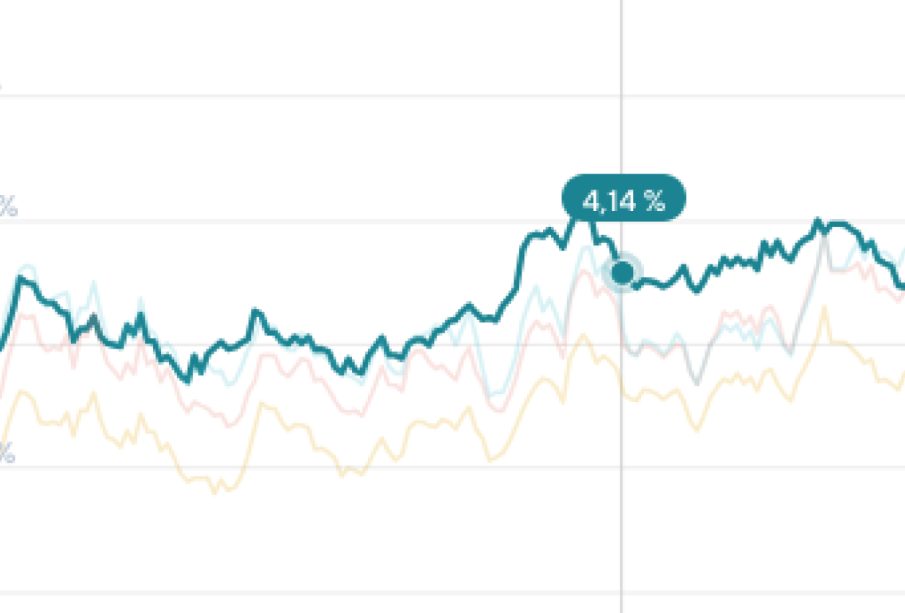

Mortgage rates today affect monthly payments, refinancing decisions and overall housing affordability for buyers and homeowners. On 4 February 2026, headline figures show 30‑year fixed rates clustered around the 6% mark. Understanding the daily quoted rates and small differences between lenders can help borrowers time applications, choose loan terms and compare refinance options.

Main details — reported rates and lender quotes

Snapshot for 4 February 2026

Several trusted sources published near‑term figures for mortgage rates today (4 Feb 2026):

- Bankrate reports the current average 30‑year fixed mortgage interest rate at 6.15%.

- A consolidated rate summary lists: 30‑year fixed 5.98%; 20‑year fixed 6.06%; 15‑year fixed 5.50%; 5/1 ARM 5.92%; 7/1 ARM 6.12%.

- U.S. Bank shows a 30‑year fixed mortgage rate at 5.990% (its page also references 6.134%).

These figures demonstrate modest variation in quoted 30‑year rates across sources and lenders on the same day. Differences may reflect lender pricing, borrower credit profiles, loan fees, and whether the figure is a headline rate or an example including typical costs.

What the numbers mean for borrowers

Borrowers seeking the lowest long‑term rate should note the 15‑year fixed option is materially lower in the reported snapshot (about 5.50%), while adjustable‑rate mortgages (5/1 ARM and 7/1 ARM) show competitive initial rates near 5.9–6.1%. Those focused on stability will compare the roughly 6% 30‑year offers, while those able to accept shorter terms or adjustable products may secure lower initial rates.

Conclusion — practical takeaways and outlook

On 4 Feb 2026, mortgage rates today are concentrated around the 6% level for 30‑year fixed loans, with some lenders and products showing slightly lower or higher numbers. Prospective buyers and refinancers should compare lender quotes, consider loan term trade‑offs and factor in fees that change the effective cost. Because rates can differ by lender and change day to day, checking up‑to‑date market averages and personalised offers remains essential when making a borrowing decision.