Mortgage rates today: What borrowers need to know

Introduction: Why mortgage rates today matter

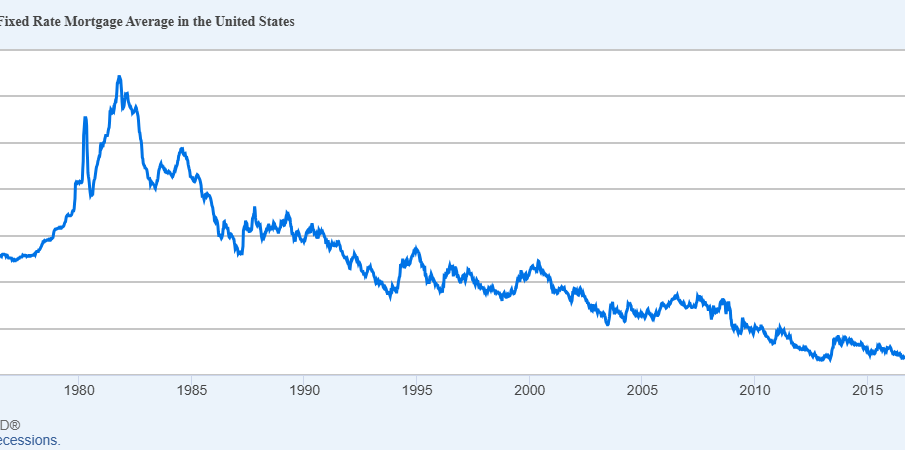

Mortgage rates today are a key determinant of housing affordability and household finances. Changes in borrowing costs affect monthly mortgage payments, the pool of eligible buyers and wider consumer spending. For homeowners, prospective buyers and the broader economy, monitoring mortgage rates today helps people make informed decisions about locking rates, remortgaging or timing property purchases.

Main body: What influences mortgage rates today

Central bank policy and inflation

Mortgage rates today are strongly influenced by central bank policy and inflation expectations. When central banks adjust policy rates to control inflation, funding costs for lenders can rise or fall, which typically feeds through to consumer mortgage pricing. Expectations about future inflation also affect long-term fixed-rate mortgages because they influence yields on government bonds.

Market conditions and lender behaviour

Beyond official interest rates, mortgage rates today reflect market conditions such as wholesale funding costs, competition among lenders and the perceived credit risk of borrowers. In periods of financial uncertainty, lenders may widen margins or tighten lending criteria, which can push mortgage rates higher for some applicants even if headline policy rates are unchanged.

House prices and demand

Housing market activity also plays a part. Strong buyer demand and rising house prices can encourage lenders to offer competitive rates to attract business, while a cooling market may reduce appetite for risk and lead to less favourable deals for borrowers.

Conclusion: What readers should take away

Mortgage rates today are shaped by a mix of macroeconomic policy, market funding conditions and housing demand. For individuals, the practical implications are straightforward: shop around for deals, consider the trade-offs between fixed and variable rates, and assess whether to lock a rate when terms meet your needs. Advisers and lenders can provide personalised projections, but keeping an eye on central bank guidance, inflation trends and market commentary will help borrowers understand likely moves in mortgage rates today and plan accordingly.