Mortgage Rates Today: Market Trends and What to Watch

Introduction: Why mortgage rates today matter

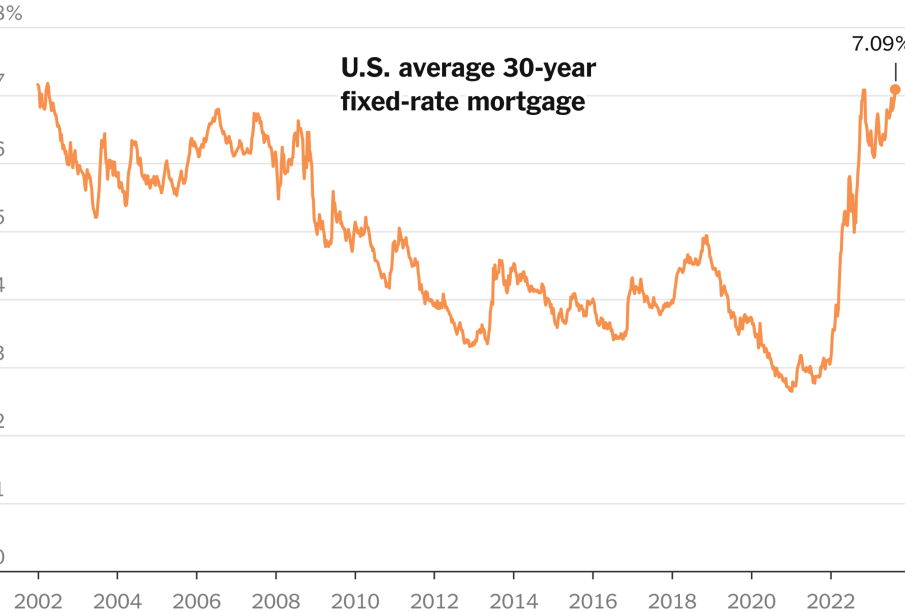

Mortgage rates today are one of the most closely watched indicators for homeowners, prospective buyers and the wider economy. Changes in borrowing costs affect monthly repayments, housing affordability and household spending, making the topic highly relevant to individuals planning to buy, remortgage or refinance. For policymakers and markets alike, movements in mortgage rates can also signal shifting inflation expectations and monetary policy direction.

Main body: Drivers and current considerations

Key factors influencing mortgage rates

Mortgage rates are influenced by a range of interconnected factors. Central bank policy rates and guidance shape short-term borrowing costs, while longer-term yields on government bonds often underpin fixed mortgage pricing. Inflation, economic growth, and employment data feed into expectations about future interest-rate moves, prompting lenders to adjust rates and product availability accordingly. Credit conditions, lender funding costs and competition in the mortgage market also play a material role.

Impact on borrowers and the housing market

For borrowers, even modest shifts in mortgage rates can substantially change monthly payments and the total cost of a loan over its term. Buyers may find their borrowing power affected when rates rise, while falling rates can improve affordability and spur demand. Existing homeowners contemplating remortgage decisions watch mortgage rates today to determine whether switching products will reduce repayments or better match their financial plans. Lenders’ criteria — such as loan-to-value thresholds and affordability assessments — interact with rates to shape who can access credit and on what terms.

Market signals and lender behaviour

Changes in mortgage pricing often reflect both macroeconomic signals and competitive dynamics among lenders. In periods of uncertainty, some lenders may tighten offerings or raise rates to manage risk, while others may use competitive pricing to attract new customers. Observers monitor changes in mortgage product availability and interest-rate spreads to gauge market sentiment.

Conclusion: What readers should watch next

Mortgage rates today remain subject to rapid change as economic data and central bank communications evolve. Borrowers should monitor official policy statements, inflation indicators and bond-market moves, and consider speaking to a mortgage adviser to assess individual options. For many households, careful timing, comparison of products and an understanding of personal affordability remain the most practical responses to shifting mortgage-rate conditions.