Key Outcomes from the Recent FOMC Meeting

Introduction

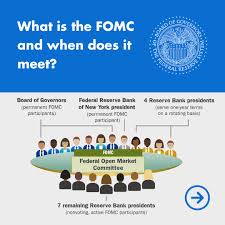

The Federal Open Market Committee (FOMC) plays a crucial role in shaping the monetary policy of the United States. Its decisions directly influence interest rates, inflation, and overall economic stability. Recently, the FOMC convened, addressing current economic conditions and outlining its approach to future monetary policies, which holds significant implications for consumers, businesses, and investors alike.

Recent FOMC Meeting Highlights

The latest FOMC meeting took place on September 19-20, 2023. One of the key takeaways from the meeting was the decision to maintain the federal funds rate at a target range of 5.25% to 5.50%. This decision reflects the committee’s cautious approach amid ongoing inflationary pressures and geopolitical uncertainties. According to the latest data, inflation has shown signs of moderation but remains above the Federal Reserve’s target rate of 2%.

Fed Chair Jerome Powell highlighted during the press conference that while inflation is moving in the right direction, it is still too early to declare victory. The committee also expressed concerns regarding global economic headwinds, particularly from regions facing economic slowdown and geopolitical tensions.

Inflation and Economic Growth

The FOMC’s decision to hold rates steady underscores its commitment to balancing inflation control with economic growth. Economic forecasts released after the meeting suggest a moderate growth trajectory for the foreseeable future, with expected GDP growth for 2023 projected at approximately 2.1%.

Moreover, labour market conditions remain strong, although recent job growth has shown signs of slowing. The unemployment rate stood at 3.8%, indicating a robust job market, which is pivotal for maintaining consumer confidence and spending.

Future Projections and Significance

The FOMC has left the door open for future rate adjustments based on evolving economic conditions, with members indicating the potential for an increase in interest rates if inflation does not continue its downward trend. Market analysts suggest that the Fed will remain vigilant, closely monitoring both domestic and international economic metrics, as any major shift could trigger further policy changes.

In conclusion, the FOMC’s recent meeting illustrates the delicate balance Federal Reserve officials are attempting to strike in navigating inflation while fostering economic growth. As we look ahead, consumers and businesses should remain informed about the developments stemming from these monetary policy decisions, as they will undoubtedly influence loan rates, spending behaviours, and investment strategies.