Investing Insights: Barclays Share Price Trends

Introduction

The share price of Barclays PLC has significant implications for investors and the wider financial markets. As one of the leading banks in the United Kingdom, fluctuations in its share price can reflect broader economic conditions, public confidence in the banking sector, and the performance of the company itself. This article examines recent movements in Barclays’ share price, the factors affecting it, and what this may mean for potential investors.

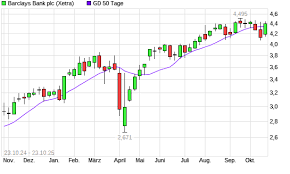

Recent Performance

As of October 2023, Barclays shares have experienced volatility typical of the current market climate. Over the past month, the share price has hovered around the £1.70 mark, with fluctuations impacted by a mix of macroeconomic factors and company-specific news. Notably, the recent trends in interest rates, inflation concerns, and economic growth forecasts have played a pivotal role in influencing investor sentiment towards financial institutions.

Key Influencers

Several factors have contributed to the recent share price actions. Firstly, the Bank of England’s monetary policy decisions have a direct impact on bank profitability and can influence stock prices significantly. Recent hints at potential interest rate hikes have led to modest increases in Barclays’ share value, as higher interest rates typically boost banks’ net interest margins.

Furthermore, Barclays announced its third-quarter financial results last month, which showed resilience amidst challenging economic conditions. The investment bank division reported a healthier performance, which offset dwindling net profits from retail banking due to increased consumer default rates. Positive results boosted investor confidence, providing a lift to the share price.

Market Sentiment and Future Outlook

Market analysts remain cautiously optimistic about Barclays’ share price heading into the next quarter. Analysts from prominent investment firms have issued mixed ratings, indicating a range of perspectives on the bank’s potential growth. As macroeconomic factors continue to evolve, particularly with regards to regulatory changes impacting the financial sector, investors are advised to monitor these developments closely.

Conclusion

In summary, Barclays’ share price movements provide valuable insights into both the company’s health and the overall banking sector’s performance. While uncertainties remain due to fluctuations in the economic landscape, the recent positive indicators may suggest a potential upward trajectory for the share price in the near future. Investors considering Barclays shares should evaluate their strategies in light of current trends and remain vigilant to shifts within the economy that could impact future performance.