Impact of Bank of England Interest Rate Decisions

Introduction

The Bank of England (BoE) plays a crucial role in the UK economy, particularly through its control of interest rates. Interest rates set by the BoE influence borrowing costs, savings rates, inflation, and overall economic growth. In recent months, the BoE has faced a challenging environment, balancing the need to curb inflation with supporting economic recovery post-pandemic. This article explores the latest developments in BoE interest rate decisions and their implications for households and businesses.

Recent Developments

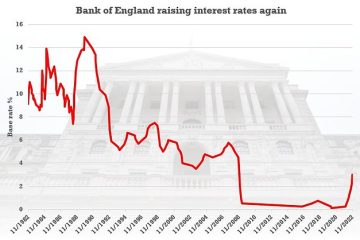

As of October 2023, the Bank of England’s Monetary Policy Committee (MPC) announced its latest interest rate decision, maintaining the base rate at 5.25%. Citing continuing pressures from inflationary trends, which have remained above the target 2%, the MPC has opted to adopt a cautious approach. Inflation peaked at 11.1% last year, causing significant concern and prompting previous rate hikes.

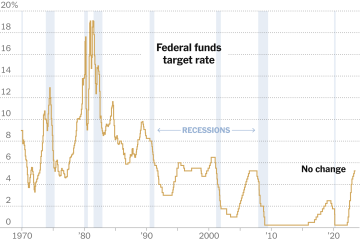

The decision to hold rates steady comes after a series of increases, which have seen the rate rise significantly from the historic lows encountered during the COVID-19 pandemic, when the base rate had dropped to 0.1%. An increase in borrowing costs impacts mortgage repayments, loan interests, and ultimately, consumer spending.

Economic Outlook

The BoE’s stance reflects a broader economic evaluation, recognising that while inflation pressure exists, the economy also faces potential recession risks. The IMF recently issued a forecast indicating a subdued growth outlook for the UK, projecting growth of only 0.5% for 2023. The slowing economic activity has made the BoE cautious in further rate adjustments to avoid exacerbating an already delicate situation.

Moreover, experts have noted that a prolonged high-interest environment could lead to an increase in defaults on personal and business loans, further stifling economic recovery. There is ongoing debate over how long the BoE will maintain this interest rate and how future decisions will align with global economic conditions, particularly in response to inflation rates across Europe and the US.

Conclusion

For financial markets, businesses, and everyday consumers, the Bank of England’s interest rate policies remain a focal point for understanding the economic landscape. While the current decision holds rates steady, potential adjustments depend on inflation trends and overall economic performance. As the UK economy continues to navigate the post-pandemic realities, staying informed about the BoE’s monetary policy will be vital for strategic financial planning for individuals and organisations alike. The BoE’s future actions in interest rate adjustments will undeniably play a pivotal role in shaping economic stability and growth in the coming months.