How Fintech Innovation Is Transforming Financial Services

Introduction: Why fintech innovation matters

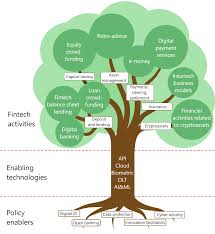

Fintech innovation — the application of technology to deliver financial services — has become a central theme in global business and public policy. Its importance lies in potential benefits for consumers, firms and the wider economy: greater access to financial services, improved efficiency, lower costs and new products. For readers, understanding fintech innovation is relevant because it affects everyday activities such as payments, borrowing and saving, and shapes how companies and regulators respond to change.

Main developments and trends

Key technological drivers

Recent advances in artificial intelligence and cloud computing underpin many fintech developments. AI is being used to improve customer service through chatbots, to enhance fraud detection, and to automate credit assessments. Cloud platforms allow start‑ups and incumbent institutions to scale services more rapidly and reduce infrastructure costs, encouraging experimentation across markets.

Business models and services

Business models in fintech continue to diversify. Digital payment solutions, embedded finance integrated into non‑financial apps, and business‑to‑business platforms for treasury or lending are among the fast‑growing areas. Established financial institutions are increasingly partnering with specialist firms, while challenger firms push for market share with user‑centred interfaces and targeted products.

Regulatory and market responses

Regulators and policymakers are adapting to the pace of innovation. Actions include creating frameworks that support competition and consumer protection, and offering regulatory sandboxes or guidance to test new products. At the same time, authorities are focusing on operational resilience and data protection as fintech services become more embedded in daily economic activity.

Conclusion: What to expect next

Fintech innovation is likely to remain a major force in the financial sector. Readers can expect continued evolution of payment methods, wider use of AI in risk management and further integration of financial services into digital ecosystems. The balance between fostering innovation and ensuring consumer protection will shape outcomes: effective regulation, transparent business practices and public trust will determine whether the benefits of fintech reach a broad population.

For consumers and businesses, staying informed about new services, fees and data‑use policies will be increasingly important as fintech continues to reshape how financial services are delivered.