How fintech innovation is reshaping finance

Introduction: Why fintech innovation matters

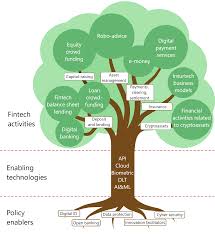

Fintech innovation is transforming how financial services are designed, delivered and regulated. Its importance lies in improving customer experience, increasing competition and enabling new business models. As firms explore digital services, understanding the forces that drive innovation—novel business models, intellectual property and partnerships—is essential for consumers, incumbents and regulators.

Main developments driving fintech innovation

New business models leading disruption

Recent analysis highlights a set of innovative FinTech business models that are at the forefront of disruption. These models reconfigure value chains, target underserved market segments and pair technology with financial services to create new propositions. By rethinking distribution, pricing and service delivery, these business models are encouraging established players to reassess their strategies.

Patents, collaboration and competitive dynamics

Innovation in fintech is not only about apps and algorithms. Intellectual property plays a critical role: patents help protect new methods and technologies, forming part of the ecosystem’s DNA. Alongside patents, collaboration—between fintechs, incumbents, researchers and vendors—fuels development. This mix of protection and partnership shapes competitive dynamics and determines which innovations scale commercially.

Why major banks struggle and the role of partnerships

Major banks often find it difficult to innovate quickly due to legacy systems, organisational inertia and risk-averse cultures. Observers emphasise that building a spirit of innovation, investing in technology development and partnering with fintech firms are key responses. Effective bank–fintech collaboration can combine incumbents’ scale and compliance experience with fintechs’ agility, helping to bring innovations to market while managing operational and regulatory risks.

Conclusion: What this means for readers

fintech innovation will continue to evolve through a combination of new business models, intellectual property strategies and collaborative approaches. For consumers, this promises more tailored and accessible services. For banks and regulators, the challenge is to foster partnerships and update capabilities to harness innovation while maintaining stability. Monitoring these developments can help stakeholders anticipate change and make informed decisions about engagement, investment and policy.