How Blockchain Technology Is Shaping Finance and Industry

Introduction: Why blockchain technology matters

Blockchain technology has moved from niche research to mainstream attention because it offers a decentralised method of recording transactions, reducing the need for trusted intermediaries and increasing transparency. Its relevance spans finance, supply chains, public services and digital identity, making developments in the field important for businesses, regulators and consumers.

Main developments and facts

Technical and market advances

Modern blockchain systems rely on distributed ledgers secured by consensus mechanisms. Proof of work (PoW) and proof of stake (PoS) remain the dominant approaches, with PoS gaining traction for its lower energy use after major networks adopted the model. Layer 2 scaling solutions and interoperability protocols aim to address throughput and cost limitations, supporting broader enterprise use.

Use cases

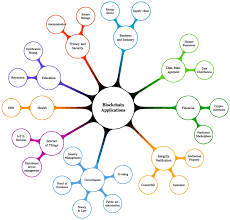

Finance has been an early adopter: tokenised assets, cross-border payments and decentralised finance (DeFi) protocols demonstrate both new capabilities and risks. Outside finance, organisations use blockchain for supply-chain provenance, verifying the origin and movement of goods; for digital identity and credentials; and in energy markets to manage decentralised resources. Non-fungible tokens (NFTs) introduced new models for digital ownership and rights management.

Regulation and institutional response

Regulatory attention has increased globally. Policymakers are focusing on consumer protection, anti-money laundering controls and market integrity. In 2023–2024 authorities in several jurisdictions advanced frameworks for crypto-assets and stablecoins, while central banks expanded exploration of central bank digital currencies (CBDCs). Regulators and supervisors continue to weigh innovation benefits against financial-stability and consumer-risk concerns.

Challenges and considerations

Key challenges include scalability, privacy, security and environmental impact for some consensus designs. Interoperability between chains and standard-setting are essential for enterprise deployment. Users and organisations must also consider governance models and legal clarity when designing or adopting blockchain-based systems.

Conclusion: Outlook for readers

Blockchain technology is likely to remain a growth area, with continued innovation in scaling, governance and regulated use-cases. Readers should expect further integration of distributed-ledger solutions into finance, supply chains and public services, accompanied by clearer regulatory regimes and cautious institutional adoption. Awareness of both opportunities and risks will be essential for organisations considering blockchain projects.