Gold price nears $5,000 per ounce — latest spot figures and market notes

Introduction: Why the gold price matters

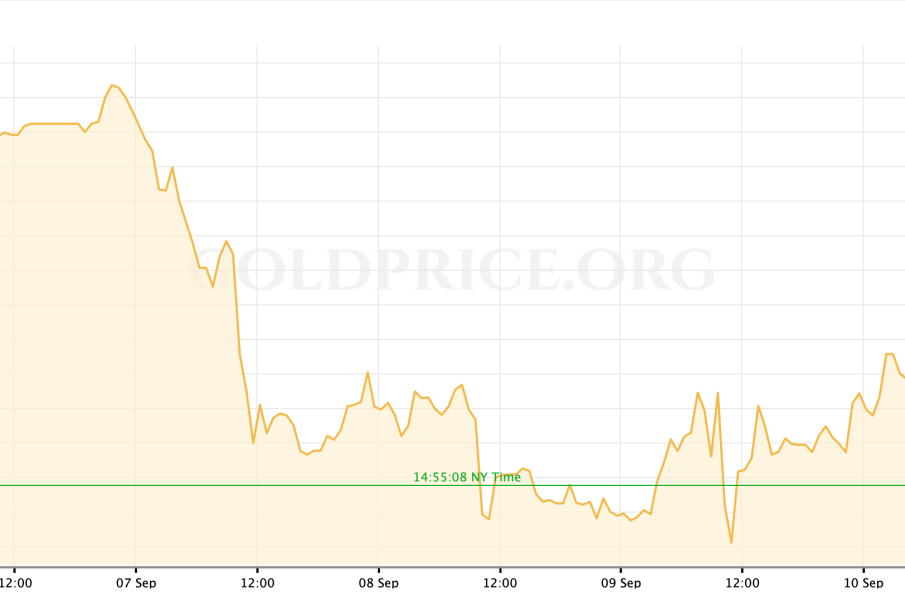

Gold remains a closely watched asset for investors, savers and consumers. Movements in the gold price can reflect shifts in risk appetite, currency strength and inflation expectations, and they directly affect the cost of bullion, coins and jewellery. Recent spot quotes show the metal trading just below the psychologically important $5,000 per ounce level, making this a timely update for readers tracking precious‑metal markets.

Main body: Latest quotes and what they show

Spot prices from major dealers

Quotes published by dealers show slight variation across platforms. JM Bullion lists the live gold spot price at $4,987.35 per ounce, describing the level as hovering just under $5,000 after repeatedly setting fresh records. APMEX, another major dealer, reports a spot price of $4,999.20 per ounce and additionally provides a per‑gram figure of $160.73.

Units, bid/ask and premiums

The spot price of gold is typically quoted in troy ounces; dealers and calculators can convert that figure into grams or other units for purchasing. APMEX also highlights common market concepts such as bid and ask prices (the highest market offer to buy and the lowest to sell) and the premium over spot charged on physical products. Buyers should note that the final purchase cost will usually exceed the raw spot quote once premiums, shipping and VAT or local taxes are added.

Tools and practical information

Online calculators and dealer tools can convert spot prices into per‑gram or per‑ounce amounts and help estimate costs for specific product sizes. Dealer pages often include FAQs explaining how spot is determined and how frequently it changes, useful resources for those new to bullion markets.

Conclusion: What this means for readers

The current cluster of quotes around $4,987–$4,999 per ounce confirms that gold is trading very close to the $5,000 threshold. For investors and buyers, small differences between dealers and the addition of premiums can affect timing and choice of purchase. Readers tracking the market should monitor live spot feeds, compare bid/ask spreads and factor in premiums and taxes when converting spot prices into actual purchase costs. Given the proximity to recent highs, even modest moves could be significant for short‑term traders and cost‑sensitive buyers.