Gifts Gone Wrong: Understanding Inheritance Tax Implications

Introduction

As the culture of gifting grows, many individuals are unaware of the potential consequences that can arise from gifts when it comes to inheritance tax (IHT). Inheritance tax can be a complex financial burden, particularly if gifts are not handled properly. With recent changes in tax laws and rising property values, understanding the implications of gifts on inheritance tax is essential for both planners and recipients.

Understanding Inheritance Tax on Gifts

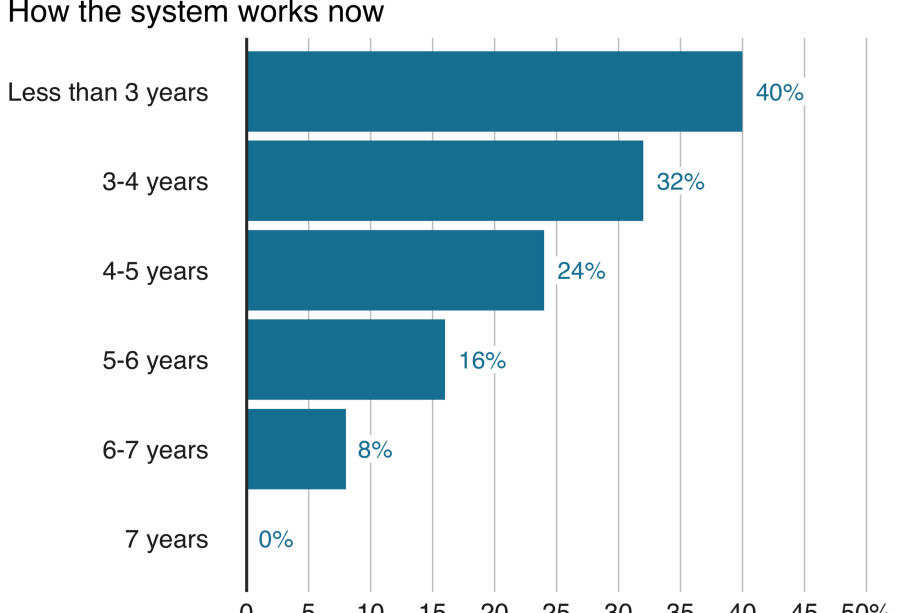

In the UK, inheritance tax is applied to an individual’s estate after their death, including gifts made within seven years prior to passing. This means that generous gifts to children, friends, or charities can come back to haunt the giver if not managed properly. The IHT threshold currently stands at £325,000, meaning any estate valued over this amount is liable for the 40% tax on the value exceeding this threshold.

Potential Pitfalls of Gifting

Individuals often mistakenly believe that giving gifts will reduce their estate’s overall value for tax purposes. However, under current regulations, gifts remain part of the estate calculation unless they fall under specific exemptions. For instance, annual exemptions allow for gifts up to £3,000 per year without incurring a tax penalty. Additionally, wedding gifts, small gifts, and certain charitable donations may also be exempt. However, exceeding these amounts without proper planning can lead to unexpected IHT liabilities.

Case Studies and Recent Events

Recent reports indicate a rise in inheritance tax disputes related to gifts gone wrong. One significant case involved an individual who gifted a property to family members while retaining the right to live in it, leading to complications during the estate evaluation. Such examples underscore the importance of transparency and legal advice when managing substantial gifts to avoid future financial repercussions.

Conclusion

As gifting becomes a more common practice among wealth individuals, understanding the nuances of inheritance tax is paramount. Families need to engage in proper financial planning and seek professional advice to ensure they navigate the inheritance tax landscape effectively. Through careful consideration and knowledge of the existing rules, individuals can gift with confidence, allowing for a smoother transition of wealth while minimising tax implications. The key takeaway is to plan ahead and consider how gifts may impact your estate and those of your loved ones in the future.