Future Outlook: Inflation Projections for 2026

The Significance of Inflation

Inflation is a critical economic indicator that affects individuals, businesses, and governments alike. It measures the rate at which the general level of prices for goods and services rises, eroding purchasing power. With the ongoing global economic recovery post-pandemic, understanding inflation trends leading into 2026 is more crucial than ever for planning future financial strategies.

Current Inflation Landscape

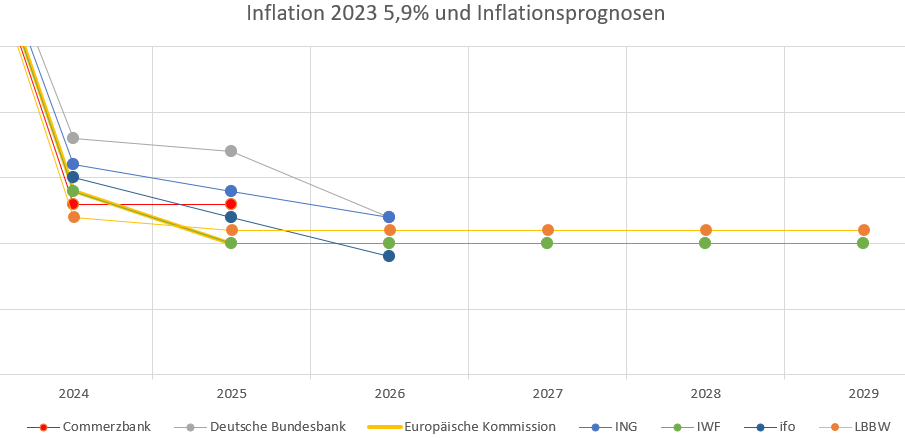

As of late 2023, inflation rates in the UK have seen significant fluctuations, largely attributed to factors such as supply chain disruptions, energy price volatility, and government fiscal policies. The Bank of England has implemented various strategies to curb rising prices, but challenges persist. Analysts predict inflation rates may stabilise around 2% to 3% in the upcoming years, although these projections can vary based on numerous influences.

Factors Influencing Inflation in 2026

Several factors will likely impact inflation rates moving into 2026. Key among these will be continued government fiscal policies, including spending and tax adjustments aimed at economic recovery. The wages growth, which has been sluggish in recent years, could also have significant implications; if wages rise significantly, this could lead to increased disposable income and demand, thus pushing prices higher.

Moreover, geopolitical tensions, particularly in energy-producing regions, could affect oil and gas prices, directly impacting consumer costs. The ongoing effects of global supply chain challenges exacerbate this uncertainty, as disruptions could lead to sustained price increases in various sectors.

Preparation and Conclusion

As we head towards 2026, it is essential for consumers and businesses to stay informed about potential inflation trends. Preparing to navigate these changes by adjusting budgets and financial strategies can mitigate the impact. Furthermore, consumers are encouraged to monitor their finances, anticipating possible rises in living costs and making prudent investment decisions.

In conclusion, while current projections suggest a stabilisation of inflation rates, the economic landscape can change rapidly, influenced by global events and policy decisions. Individuals and businesses must remain vigilant and adaptable to the potential challenges that inflation in 2026 may bring.