Forex Factory: Practical News and Tools for Currency Traders

Why Forex Factory matters to traders

In fast-moving currency markets, timely information and shared insight are essential. Forex Factory is recognised among retail FX traders as a central hub where an economic calendar, market news and community discussion converge. Its relevance lies in helping traders anticipate volatility, align positions with macro events and tap into peer discussion for fresh perspectives.

Main features and how they are used

Economic calendar

The economic calendar highlights scheduled macroeconomic releases and central bank events that commonly drive FX volatility. Traders use the calendar to identify potential market-moving dates, set risk controls ahead of announcements and avoid unwanted exposure during high-impact news.

News feed and market information

A continuous news feed summarises headlines and market developments across currencies, geopolitics and macroeconomics. This collated information lets traders follow broader themes — for example, changes in interest-rate expectations or trade tensions — that influence currency trends.

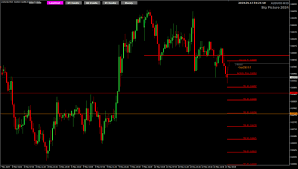

Community forums and trade ideas

Forums on the site host discussions on strategy, technical setups and broker experiences. Many users post trade ideas, charts and post-trade analysis. While community insight can surface useful perspectives, forum content should be treated as opinion and verified independently against primary sources and personal risk criteria.

Tools and usability

Additional tools and user features, such as watchlists and threads for specific currency pairs, help traders organise information and track sentiment. The combination of calendar, news and community threads makes the site convenient for both intraday and longer-term market planning.

Conclusion: practical value and cautions

Forex Factory remains a practical resource for traders seeking consolidated economic data, market headlines and peer discussion. Its value is strongest when used alongside direct market data, reliable brokers and a clear risk-management plan. Looking ahead, traders who combine calendar-driven planning with disciplined position sizing and independent verification will be best placed to respond to the volatility highlighted on platforms such as Forex Factory.