Fintech Innovation Drives Change in Financial Services

Introduction: Why fintech innovation matters

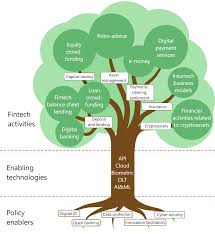

Fintech innovation has become central to how consumers and businesses access financial services. Developments in digital payments, automated lending, data analytics and embedded finance are changing expectations for speed, cost and convenience. The topic is relevant to customers, firms and policymakers because innovation can expand access to finance, increase competition and introduce new operational and regulatory challenges.

Main developments and trends

Payments and digital wallets

Recent innovation has focused strongly on payments. Digital wallets and instant-payment rails are enabling near real-time transfers and simpler checkout experiences. This shift reduces friction for merchants and consumers, and supports commerce across channels including mobile and online.

Data-driven credit and personalised services

Fintech firms increasingly use alternative data and automated decision-making to assess creditworthiness and deliver personalised financial products. Automation can speed up approval processes and extend lending to underserved customers, while also raising questions about model transparency and fairness.

Embedded finance and platform integration

Embedding financial services into non-financial platforms is another notable trend. Retailers, software providers and apps are integrating payments, lending and insurance into their user journeys, creating new revenue models and blurring lines between traditional banks and technology companies.

Security, resilience and regulation

As fintech innovation advances, cybersecurity, operational resilience and consumer protection remain priorities. Firms and regulators are focused on safeguarding customer data and ensuring systems remain robust under stress. Collaboration between industry and regulators is important to manage risks while allowing beneficial innovation to flourish.

Conclusion: Implications and outlook

Fintech innovation is likely to continue reshaping the financial landscape by improving access, cutting costs and enabling new services. For consumers and businesses, this promises more choice and convenience. For incumbent institutions and regulators, it presents both opportunity and responsibility: to adopt effective technologies, manage new risks and ensure outcomes that are fair and secure. Monitoring developments and fostering constructive engagement between innovators and policymakers will be key to realising the benefits of fintech innovation for the wider economy.