Finding the Best Cash ISA Options for Your Savings in 2023

Introduction to Cash ISAs

In a climate of rising interest rates and increasing living costs, the importance of finding the best Cash Individual Savings Account (ISA) cannot be overstated. A Cash ISA offers a tax-free saving environment, making it an attractive option for many UK savers. With HMRC reporting increased usage of ISAs in recent years, understanding which Cash ISA providers offer the most competitive rates and benefits is crucial for maximising your savings.

What to Look for in a Cash ISA

When searching for the best Cash ISA, there are several factors to consider:

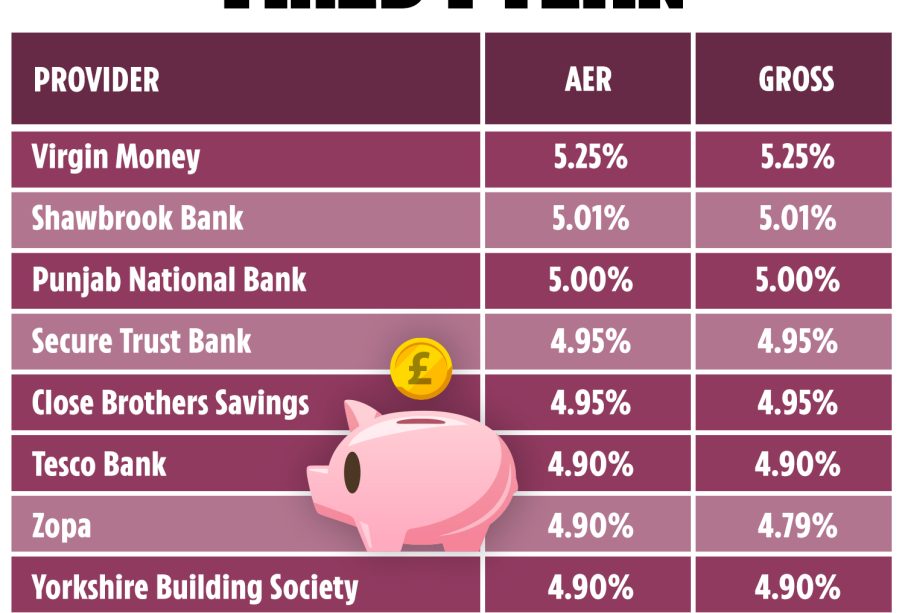

- Interest Rates: The interest rate offered is often the primary consideration. As of October 2023, several banks and building societies have increased their interest rates in response to the Bank of England raising the base rate.

- Access to Funds: Different Cash ISAs offer varying levels of access to your funds. While some accounts are instant access, others may require you to lock away your money for a fixed term in return for higher rates.

- Deposit Limits: Cash ISAs have an annual subscription limit of £20,000 for the 2023/2024 tax year. Understanding how much of this limit a provider allows you to deposit can affect your overall savings strategy.

- Account Types: Cash ISAs can be either easy-access, fixed-rate, or lifetime ISAs. Your choice will depend on your individual financial goals and plans.

Top Cash ISA Providers in 2023

Recent evaluations indicate that the following providers are currently among the best for Cash ISAs:

- Yorkshire Building Society: Offers an attractive easy-access Cash ISA with rates up to 3.25%, one of the highest available.

- Nationwide Building Society: Provides competitive rates for fixed-rate ISAs, with their 3-year fixed ISA currently offering 3.35% interest.

- HSBC: Their online Cash ISA features a competitive interest rate of 3.4%, alongside the benefit of easy online management.

Conclusion

As we step into the remainder of 2023, securing the best Cash ISA should be a priority for anyone looking to save tax-free. With rising interest rates, now is the ideal time to shop around and compare various providers and their offerings. Whether you prefer the flexibility of an easy-access account or the certainty of a fixed-rate ISA, making an informed decision will enhance your overall savings strategy. By taking the time to evaluate your options, you can make the most of your savings and reach your financial goals more effectively.