Exploring the S&P 500: Importance and Current Trends

Introduction

The S&P 500, or Standard & Poor’s 500, is one of the most influential stock market indices in the world. It comprises 500 of the largest publicly traded companies in the United States, providing a broad view of the market’s overall performance. As a benchmark for the U.S. equity market, the S&P 500 is crucial for investors, economists, and policymakers, making it essential to understand its movements and underlying factors.

Recent Performance of the S&P 500

As of October 2023, the S&P 500 has shown remarkable resilience, recovering steadily from previous market volatilities. Recent data indicates that the index has seen a year-to-date increase of approximately 15%. This recovery can be attributed to various factors, including a robust job market, resilient consumer spending, and the steadiness of interest rates.

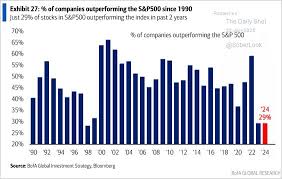

One significant driver of this growth has been the performance of technology stocks, which dominate the index. Companies such as Apple, Microsoft, and Amazon have not only contributed to the index’s gains but have also been pivotal in defining market trends. However, the index’s performance has not gone unnoticed by market analysts, with concerns about inflation and rising interest rates impacting future growth projections.

Factors Influencing the S&P 500

The S&P 500 is influenced by a myriad of factors. Key economic indicators such as unemployment rates, consumer confidence, and manufacturing output significantly affect market sentiment. Additionally, global events—including geopolitical tensions and economic policies—can create volatility.

The Federal Reserve’s monetary policy, particularly interest rate changes, is another critical factor. Investors closely monitor the Fed’s stance, as indications of future rate hikes can lead to market fluctuations. For example, any hints of tighter monetary policy in response to inflation could impact investor confidence in equities and slow the growth trajectory of the S&P 500.

Conclusion

Understanding the S&P 500 is essential for anyone looking to navigate the complexities of the stock market. The index not only serves as a gauge of economic health but also reflects investor sentiment regarding future economic conditions. As we move forward, monitoring the S&P 500 will remain pivotal for making informed investment decisions. With ongoing developments in the economy and potential changes in the Federal Reserve’s policies, investors are advised to stay updated on trends associated with this widely recognised index. The S&P 500 will continue to play a crucial role in shaping investment strategies and economic predictions.