Exploring the Nasdaq 100: A Vital Index for Investors

Introduction

The Nasdaq 100 is a vital stock market index that tracks 100 of the largest non-financial companies listed on the Nasdaq Stock Market. Established in 1985, it is widely considered a barometer for technology and growth-oriented sectors in the stock market. With technology giants like Apple, Amazon, and Microsoft leading the charge, understanding the Nasdaq 100’s performance is essential for investors and analysts alike, especially in today’s rapidly evolving economic landscape.

Recent Market Trends

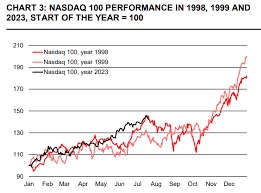

As of October 2023, the Nasdaq 100 has seen significant volatility influenced by various factors including inflation rates, interest rate changes, and ongoing geopolitical tensions. Recently, the index has rebounded from earlier losses in the year, driven by strong earnings reports from tech companies and increased consumer demand for digital services. The rebound has raised investor confidence, showing a potential recovery in sectors previously impacted by the economic downturn.

Moreover, innovations in artificial intelligence and the digital economy continue to fuel growth for Nasdaq-listed companies. Analyst forecasts suggest that the index could maintain a bullish trend if tech firms continue to outperform expectations in earnings reports, especially in the face of competition and regulatory concerns. For instance, the latest quarterly results have shown a 12% year-on-year increase in earnings for many major players, significantly boosting the Nasdaq 100.

Implications for Investors

For investors, the Nasdaq 100 offers both opportunities and challenges. Its heavy weighting towards technology stocks means that it can present significant returns, but also increased risk associated with market fluctuations. Analysts advise a diversified investment strategy when engaging with the Nasdaq 100, balancing exposure to high-growth tech firms with more stable, less volatile investments.

The current market environment suggests that investors should be attentive to macroeconomic indicators that can influence stock prices. With the Federal Reserve’s monetary policy and economic recovery from the pandemic impacting market performances, staying informed about these changes is crucial for making sound investment decisions.

Conclusion

The Nasdaq 100 remains a pivotal index for both individual and institutional investors looking to navigate the stock market, particularly in technology and growth sectors. As we approach 2024, the outlook for the index appears cautiously optimistic, provided that the companies represented continue to innovate and adapt in a rapidly changing world. Understanding trends and market movements related to the Nasdaq 100 will be essential for investors aiming to capitalise on potential growth while effectively managing risks.