Everything You Need to Know About Cash ISAs in 2023

The Importance of Cash ISAs

Cash ISAs (Individual Savings Accounts) are a vital component of the UK savings landscape, allowing individuals to save money tax-free. With the ongoing financial uncertainties and rising inflation, understanding the role and benefits of Cash ISAs has never been more relevant.

What is a Cash ISA?

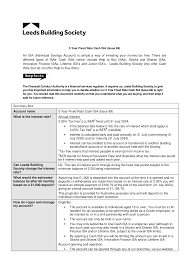

A Cash ISA is a type of savings account that allows you to earn interest on your savings without paying tax on the interest earned. For the 2023/2024 tax year, the annual ISA allowance is set at £20,000, which means you can put this amount into a Cash ISA, stocks and shares ISA, or a combination of both. The tax advantages make Cash ISAs particularly attractive for UK savers seeking to maximise their savings potential.

Current Market Trends

As of October 2023, the Bank of England’s base rate is at a historic high, prompting many banks and building societies to offer competitive interest rates on Cash ISAs. Research indicates that the average interest rate on Cash ISAs now stands at around 2.5%, with some providers offering rates upwards of 3%. This trend reflects the increasing importance of Cash ISAs as a safe haven for savers looking to protect their money from inflation while enjoying tax benefits.

Who Should Consider a Cash ISA?

Cash ISAs are suitable for various groups, including individuals who prefer low-risk savings options, those saving for short-term goals, and first-time savers. Unlike stocks and shares ISAs, Cash ISAs do not entail market risks, making them an appealing option for conservative investors. Furthermore, with the rising cost of living, many are prioritising their savings, and Cash ISAs offer a straightforward way to do so.

How to Open a Cash ISA

Opening a Cash ISA is relatively straightforward. Most major banks and building societies offer Cash ISAs, and you can either open one online or in-person. When choosing a provider, it’s essential to compare interest rates, withdrawal options, and any associated fees. Remember that once you have committed your annual allowance, you cannot change accounts until the next tax year.

Conclusion and Future Outlook

As economic conditions continue to evolve, Cash ISAs remain a critical option for UK savers seeking tax-efficient ways to grow their wealth. With interest rates on the rise, now may be an opportune time to consider opening a Cash ISA or reviewing your existing savings strategy. Given the uncertain economic climate, having a secure and flexible savings solution like a Cash ISA could be a key component of maintaining financial stability in the future.