Emerging Trends in April Mortgages for 2023

The Importance of Understanding April Mortgages

As spring ushers in the buying season, April is a pivotal month for the mortgage market. Understanding the trends and movements within the mortgage landscape during this period is crucial for potential homebuyers, real estate professionals, and economists. With rising interest rates, changes in regulations, and a fluctuating housing market, the developments in April 2023 could significantly impact borrowers’ decisions and economic stability.

Current Trends in the Mortgage Market

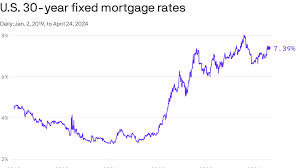

In April 2023, the UK mortgage market has experienced notable fluctuations. According to the Bank of England, the average mortgage rate reached 4.5%, a slight increase from earlier months due to ongoing concerns about inflation and cost of living. This increase marks continued volatility compared to the historically low rates seen in 2020 and 2021, directly influencing borrower affordability.

Moreover, the shift in Bank of England policies to combat inflation has led to stricter lending criteria. Many banks and lenders have revised their assessment processes, which may affect the approval rates for new mortgages. Potential homebuyers are advised to conduct thorough research and prepare their finances accordingly.

Government Initiatives and Economic Factors

The government has introduced various initiatives aimed at supporting first-time buyers and homeowners looking to remortgage. The Help to Buy scheme remains popular among first-time buyers as it allows access to lower deposit requirements. Additionally, the UK’s recent budget statements have revealed potential tax relief options aimed at alleviating the mortgage burden on struggling homeowners.

Supply chain issues and inflation have further complicated the property market. Reports from the National Association of Realtors indicate a persistent shortage of housing stock, putting upward pressure on prices. As a result, buyers must navigate a competitive market, leading to potential bidding wars which can surprise many first-time homebuyers.

Conclusion and Future Insights

April 2023 presents a complex landscape for mortgages, enhanced by fluctuating interest rates and government initiatives aimed at supporting homebuyers. It is essential for prospective buyers to exercise due diligence by keeping informed about the latest trends and mortgage products available to them.

Looking ahead, industry experts recommend close monitoring of the Bank of England’s policy announcements, as they will drive mortgage rates and lending opportunities throughout the year. For potential homebuyers, remaining adaptable and well-informed will be crucial for making savvy financial decisions in a challenging environment.