Current Trends in Vodafone Share Price

Introduction

The Vodafone share price is a crucial indicator of the telecom giant’s market performance and investor sentiment. With the rapid evolution of the telecommunications industry, understanding the factors influencing Vodafone’s stock performance is vital for investors and analysts alike.

Current Market Performance

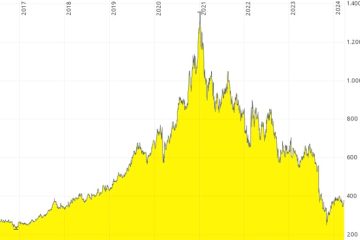

As of October 20, 2023, Vodafone Group Plc (LON: VOD) saw fluctuations in its share price, closing at approximately £1.10. This marks a slight decline from previous sessions but remains a topic of interest for market watchers. Investors are closely monitoring the ramifications of recent financial reports released by the company, which highlighted a mixed outlook for its operations in Europe and emerging markets.

Factors Influencing Vodafone Share Price

The recent volatility of Vodafone’s share price can be attributed to several factors, including:

- Market Demand: The demand for 5G services continues to rise, and Vodafone’s role in expanding its infrastructure in Europe plays a critical part in shaping its future revenue streams.

- Financial Performance: The latest earnings report indicated a dip in revenues, primarily attributed to increased competition and regulatory challenges in key markets. Investors are reacting to these figures, leading to fluctuations in the stock price.

- Strategic Developments: Vodafone’s ongoing efforts to streamline its operations and focus on core markets, including potential mergers and partnerships, have also been pivotal in shaping investor reactions.

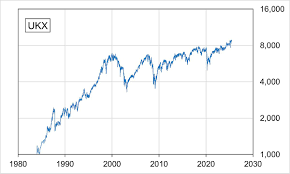

Comparative Analysis

When analysed against competitors such as BT Group plc and Telefonica S.A., Vodafone’s share price has displayed resilience amidst challenging market conditions. While competitors struggle with similar issues, Vodafone’s innovative approach to services such as IoT (Internet of Things) could potentially offer a competitive edge in the long run.

Future Outlook

Looking ahead, analysts project that Vodafone’s share price may experience upward movement as the company further integrates 5G technology and expands its customer base across various segments. However, external economic factors, including inflation and currency fluctuation, could still pose risks to its performance.

Conclusion

In summary, the Vodafone share price is underpinned by a mix of internal and external factors that reflect a dynamic telecommunications environment. With looming challenges and potential growth opportunities, investors are encouraged to remain vigilant and informed about market trends affecting the Vodafone stock. Staying updated with economic conditions and company announcements will be crucial for making sound investment decisions.