Current Trends in UK House Prices: Insights for 2023

Introduction

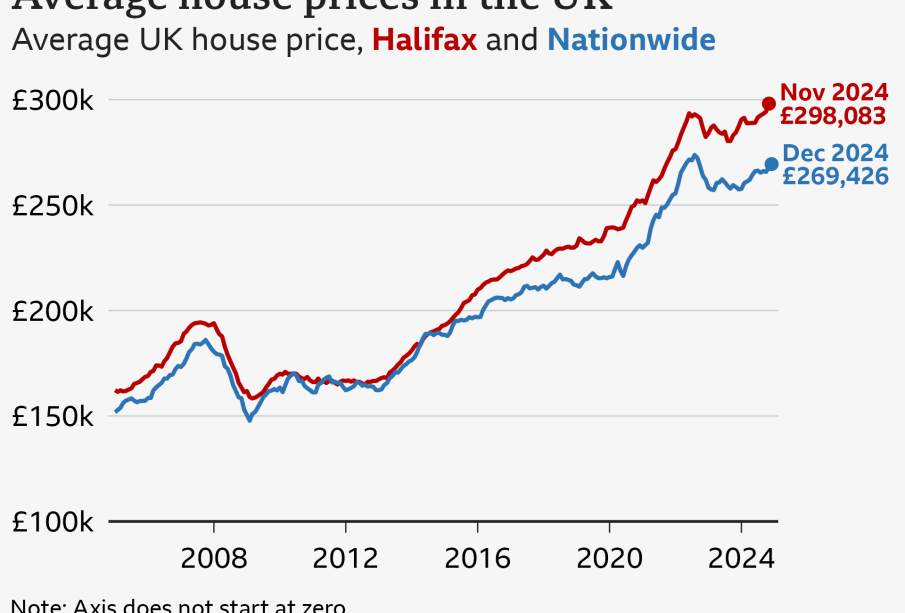

The housing market in the United Kingdom has been a pivotal topic over the last few years, marked by rapid changes influenced by economic shifts and market dynamics. Understanding the trends in UK house prices is crucial for potential homeowners, investors, and policymakers alike, as these prices directly impact housing affordability, consumer confidence, and overall economic health.

Current State of UK House Prices

As of early 2023, UK house prices have remained a subject of extensive scrutiny. According to recent data from UK Finance, the average house price in the UK reached £286,000, representing a 10% decrease from the peak in mid-2022. The decline is largely attributed to rising interest rates and the cost-of-living crisis that have dampened buyer enthusiasm.

Regions such as London saw a more pronounced dip, with prices down by 15% compared to the previous year, while areas in the North and Midlands have shown resilience with minimal price fluctuations. The Nationwide Building Society reported that although transaction volumes have decreased, there is still a competitive market interest, particularly in affordable segments.

Factors Influencing House Prices

Several key factors are influencing the current landscape of UK house prices. The Bank of England’s interest rate hikes, aimed at combating inflation, have significantly impacted mortgage affordability. Analysts indicate that mortgage repayments have risen by as much as 30% for new borrowers compared to a year ago.

Additionally, the ongoing cost-of-living crisis has constrained disposable income, limiting potential buyers’ ability to enter the market. However, estate agents suggest that there is still a pool of buyers eager to purchase homes, albeit with more caution. The Help to Buy and Shared Ownership schemes continue to offer vital support for first-time buyers in particular.

Conclusion and Future Outlook

Looking ahead, experts predict a gradual stabilisation in UK house prices by late 2023. The anticipated easing of inflation and potential reductions in interest rates may encourage more buyers to return to the market, although significant challenges remain.

The housing market’s recovery will be closely monitored, particularly as public confidence in economic stability grows. For potential buyers and investors, staying informed about market trends is essential, as the balance between supply and demand will significantly shape price developments in the coming months. As we move forward, understanding the dynamics of house prices in the UK will remain vital for making informed decisions in this ever-evolving market.