Current Trends in SSE Share Price

Introduction

The SSE share price holds significant importance for investors tracking the performance of one of the UK’s leading energy companies, SSE plc (Scottish and Southern Energy). As a major player in electricity and gas, SSE’s stock performance reflects not only its operational efficacy but also broader trends in the energy market, especially in light of recent shifts towards renewable energy sources and government regulations.

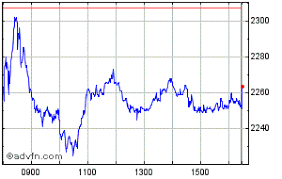

Recent Share Price Performance

As of October 2023, the SSE share price has demonstrated considerable fluctuations due to various market dynamics. The share price opened at £18.50 in January 2023 and peaked at around £21.00 in June, boosted by positive earnings reports and an increase in energy prices. However, recent predictions surrounding the energy sector’s regulations and market shifts have contributed to a decline to approximately £19.75 by mid-October.

Market analysts from reputable financial institutions are keeping a close eye on SSE’s performance. Factors like the integration of renewable energy projects and the company’s commitments to environmental sustainability play essential roles in investor sentiment and share price movements. A switch in government policy regarding energy pricing directly impacts the profitability landscape for companies like SSE, which adds another layer of complexity to its share price trajectory.

Impact of External Factors

Investors need to consider external factors that affect stock performance. SSE has recently been in discussions about potential mergers and acquisitions which may reshape its market position. There are also concerns regarding fluctuating gas prices, geopolitical tensions, and climate change regulations that significantly influence investor confidence and predictability of the SSE share price. Furthermore, as the company targets net-zero emissions by 2050, investments in green technologies could either bolster its share price in the long term or present short-term challenges due to transition costs.

Conclusion

The SSE share price remains a vital indicator of the company’s market position amid changing regulatory and environmental landscapes. Current trends suggest a cautious outlook due to external pressures, yet the company’s commitment to renewable initiatives provides potential for future growth. Investors are advised to stay informed about developments within the energy sector as they directly influence SSE’s operational strategies and share price movements.

Ultimately, keeping track of SSE’s performance in context with industry trends will serve as a valuable strategy for investors navigating the complexities of the energy market. With various analysts rating the shares differently, potential investors may find it worthwhile to review these insights thoroughly before making decisions.