Current Trends in Rolls Royce Share Price

Introduction

The Rolls Royce share price has garnered significant attention in recent months due to the company’s strategic decisions and market fluctuations. As a renowned manufacturer in the aerospace and defence sectors, the performance of Rolls Royce’s shares can provide insight into the broader economic landscape, especially considering the ongoing recovery from the pandemic and the rising costs of energy.

Recent Developments

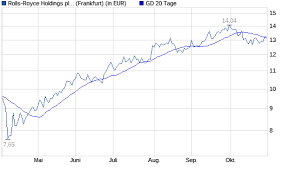

As of October 2023, the Rolls Royce share price stands at approximately £1.65, reflecting a year-to-date increase of around 20%. This uptick is largely attributed to the company’s improved financial performance, stemming from a strong recovery in the aviation sector. After facing significant challenges during the pandemic, including a drop in air travel, Rolls Royce has seen a resurgence in demand for its aero engines, boosted by a renewed interest in long-haul flights.

The company’s management has also undertaken various cost-cutting measures and efficiency improvements, which have been well-received by investors. During the latest quarterly earnings report, Rolls Royce announced an increase in revenues by 15% compared to the previous year, signalling a robust recovery and solid operational performance.

Market Analysis

Analysts have noted that the Rolls Royce share price is influenced by various external factors, including the global economic conditions, changes in consumer travel behaviour, and fluctuations in energy prices. The rise in oil prices has raised concerns for the airline industry, directly impacting engine demand. However, the company has positioned itself for growth with strategic partnerships and innovation in sustainable aviation technologies, including electric and hybrid engines, which could play a crucial role in its future market performance.

Investor Sentiment and Future Outlook

Investor sentiment towards Rolls Royce shares remains cautiously optimistic. Many analysts suggest that while the share price is currently on an upswing, investors should closely monitor geopolitical events and energy costs, as these could lead to volatility. Predictions indicate that if the demand for air travel continues to bounce back and Rolls Royce successfully implements its green technology initiatives, the share price may experience further growth over the coming year.

Conclusion

The Rolls Royce share price is currently in a positive trajectory, reflecting a broader recovery in the aerospace sector. For investors, understanding market dynamics and company developments will be crucial in making informed decisions. With promising growth strategies and an adaptive approach, Rolls Royce could well solidify its reputation as a market leader in aviation and beyond.