Current Trends in Netflix Stock: What Investors Should Know

Introduction

The fluctuation of Netflix stock has garnered significant attention from investors and market analysts alike. As one of the leading streaming services globally, Netflix plays a pivotal role in shaping market trends, especially within the technology and entertainment sectors. Its stock performance not only impacts its corporate narrative but also provides insights into broader investor sentiment towards the tech industry.

Recent Performance and Market Trends

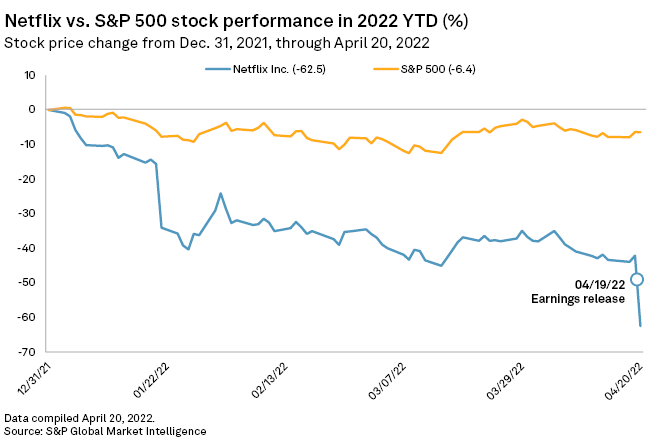

As of October 2023, Netflix’s stock saw a notable surge, climbing approximately 20% in the last quarter, buoyed by increased subscriber growth and strategic content investments. According to recent reports, Netflix added over 8 million new subscribers in the last quarter alone, a substantial increase driven by a successful slate of original series and films, alongside enhancements in user engagement through interactive content. This growth trajectory has prompted many analysts to revise their target prices for the stock upwards.

Additionally, Netflix has been proactive in expanding its reach into international markets, with specific focus on Asia and Europe. The introduction of localized content has proved crucial in gaining traction among diverse audiences, further solidifying its competitive edge against major rivals like Disney+, Amazon Prime Video, and HBO Max. Analysts believe these strategies not only enhance subscriber numbers but also improve the overall financial health of the company, evident through a rise in revenue forecasts for 2024 that are projected to exceed $45 billion.

Challenges Ahead

However, despite its recent performance, Netflix does face substantial challenges. Increased competition is one of the foremost concerns, as new streaming platforms continue to emerge. This has not only led to a fragmentation of audiences but also escalated content production costs significantly. Furthermore, the potential impact of economic recession may affect consumer spending on entertainment subscriptions moving forward.

Moreover, there’s an ongoing conversation regarding the sustainability of Netflix’s high expenditure on original content. While it has effectively attracted and retained viewers, maintaining profitability amidst rising costs presents an ongoing challenge for the company.

Conclusion

In summary, Netflix stock represents a compelling opportunity for investors, driven by significant growth in subscriptions and an expansive content strategy. However, potential pitfalls, including intense competition and rising costs, necessitate careful consideration. As the company navigates these challenges, its approach to adaptation and innovation will be critical in sustaining its stock performance. Investors should stay informed and conducted due diligence as Netflix continues to be a major player in the highly competitive streaming landscape.