Current Trends in National Grid Share Price

Introduction

The National Grid share price is a critical metric for investors in the UK energy sector, reflecting the company’s performance and the broader market climate. With energy prices fluctuating and sustainability efforts gaining momentum, understanding the dynamics of National Grid’s share price is more relevant than ever for investors and stakeholders.

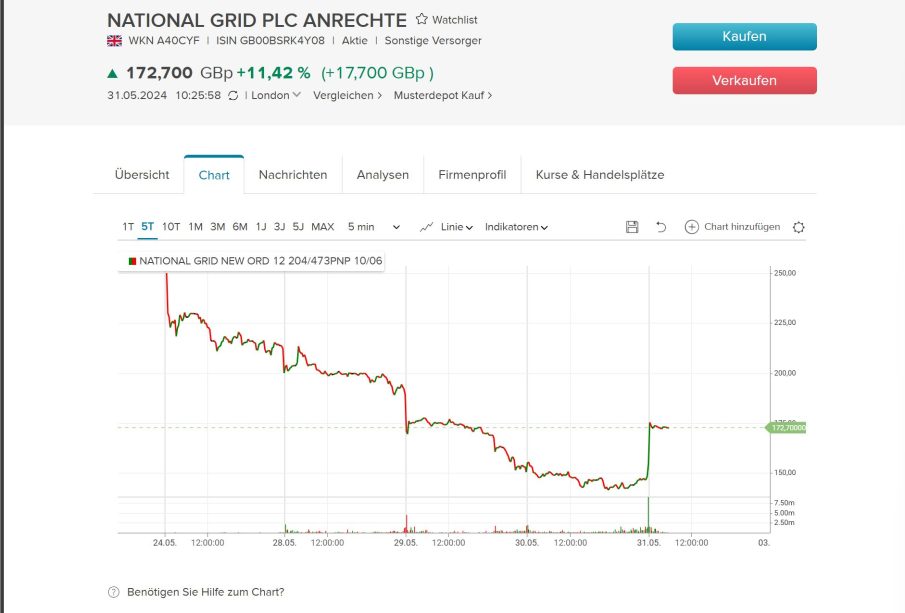

Current Share Price Overview

As of mid-September 2023, the share price of National Grid plc is approximately £10.75, showcasing a significant uptick from £9.68 at the beginning of the year. This rise correlates with increased investor confidence in the energy sector, especially given the ongoing transition to renewable energy solutions and the company’s commitments to sustainability.

Recent Developments

The positive momentum in the share price can be attributed to several factors. One of the key drivers has been the National Grid’s recent announcement regarding its ambition to significantly enhance its electrical infrastructure to accommodate more renewable energy sources. This strategic move has been welcomed by analysts and is believed to position the company well for future growth.

Additionally, regulatory support for green initiatives and the government’s push towards a net-zero economy have fostered a conducive environment for companies like National Grid. Recent reports suggest that UK energy prices might stabilise in 2024, which could further bolster the share price as consumer confidence returns to the market.

Future Outlook

Looking ahead, analysts predict that the National Grid share price may continue to reflect the company’s strategic initiatives and the overall performance of the national energy market. Factors such as potential changes in government policy, the global energy crisis, and ongoing technological advancements will significantly influence market sentiment.

Investment analysts widely recommend a ‘hold’ position on National Grid shares, citing the firm’s resilient dividend yield and its forward-thinking approach as substantial positives. With the shares currently trading at a price-to-earnings ratio that is deemed reasonable in comparison to its peers, the outlook remains cautiously optimistic.

Conclusion

In conclusion, the National Grid share price continues to be a focal point for investors, influenced by macroeconomic factors, regulatory changes, and the company’s proactive steps towards embracing sustainable energy solutions. As we move towards the end of 2023, keeping an eye on ongoing developments within the energy sector will be essential for making informed investment decisions.