Current Trends in Lloyds Share Price: An Overview

Introduction

The Lloyds Banking Group, a major player in the UK financial sector, has garnered significant attention from investors due to its fluctuating share price. Understanding the dynamics of Lloyds share price is not just vital for potential investors but also for those monitoring the overall health of the UK banking industry. As of October 2023, several factors are influencing the valuation of Lloyds shares, making this an important topic for financial news.

Current Market Performance

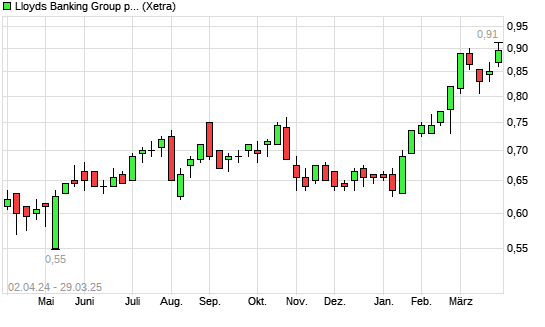

As recently reported, Lloyds share price has seen considerable movement in the last few months. The price has ranged between £0.45 and £0.65 per share, reflecting both the broader market trends and specific events affecting Lloyds itself. Analysts pinpoint several factors contributing to this volatility, notably the Bank of England’s interest rate decisions, regulatory changes, and the overall economic outlook.

In September 2023, following a decision by the Bank of England to maintain interest rates, Lloyds shares experienced a notable uptick, closing at £0.62, a significant rise from earlier months. However, subsequent economic reports indicated increased inflationary pressures which caused the share price to re-evaluate, leading to fluctuations driven by market sentiment and investor behaviour.

Influencing Factors

There are several critical factors influencing the Lloyds share price currently:

- Economic Indicators: Inflation rates, unemployment data, and consumer spending statistics heavily impact investor sentiment and, consequently, Lloyds share price.

- Bank of England Policy: Interest rate policies directly affect borrowing costs for consumers and businesses, making the UK banking sector responsive to changes in monetary policy.

- Geopolitical Events: Global economic conditions and uncertainties, such as Brexit repercussions and international trade relations, continue to create volatility in the UK market.

Investor Sentiment

Investor sentiment towards Lloyds has generally been cautious but with optimism for recovery in a post-pandemic economy. Recent analyst reports suggest that Lloyds could be undervalued, particularly if economic recovery continues. Projections indicate that if the UK economy strengthens and inflation stabilizes, Lloyds share price could see a substantial increase, reaching towards £0.70 per share by late 2023.

Conclusion

In summary, the Lloyds share price continues to be a topic of interest among investors, shaped by economic trends and market dynamics. Keeping an eye on fiscal policies, economic conditions, and the banking sector’s performance will be essential for those looking to invest. As the UK economy outlines its path towards recovery, observant investors may find opportunities within Lloyds Banking Group to leverage for potential growth.