Current Trends in GSK Share Price and Market Impact

Introduction

The share price of GlaxoSmithKline (GSK), one of the world’s leading pharmaceutical companies, has been a focal point for investors as it reflects the company’s performance and prospects in the ever-competitive healthcare industry. As the global economy continues to evolve post-pandemic, understanding the movements of GSK’s share price is crucial for both seasoned investors and those new to the stock market.

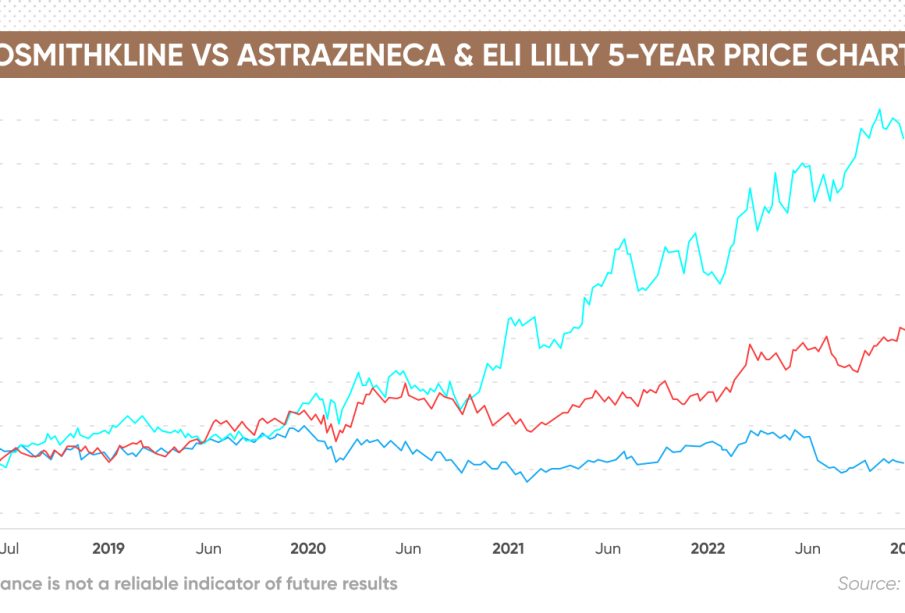

Recent Trends in GSK Share Price

Over the last few months, GSK’s share price has seen significant fluctuations. As of mid-October 2023, the share price was hovering around £14.50, which marks a modest increase from the previous quarter. The stock experienced a low of £12.50 earlier this year but has shown resilience amidst broader market trends. Analysts attribute this recovery in part to GSK’s strong performance in vaccines and its ongoing commitment to research and development.

Factors Influencing the Share Price

One of the primary drivers of GSK’s share price is the company’s robust pipeline of products, including treatments for respiratory diseases and vaccines. Recently, GSK announced promising results from clinical trials for a new vaccine that addresses RSV, which is expected to boost investor confidence and potentially increase sales in upcoming quarters.

Moreover, GSK’s strategic focus on cutting-edge technology and partnerships with biotech firms has also been positively received by the market. The company is set to benefit from increased demand for innovative treatments, especially as healthcare systems worldwide continue to adapt to emerging health challenges.

Market Analysis and Future Projections

Market analysts remain cautiously optimistic about the future of GSK shares. The British pharmaceutical sector has shown resilience, with GSK’s share price expected to stabilize as the company continues to innovate and expand its market reach. Experts predict a potential rise to approximately £16 per share in the next six months, contingent upon successful product launches and regulatory approvals.

Investor sentiment has been bolstered by GSK’s recent strategic decisions, including a focus on transparency and sustainability, which resonate with modern investors’ values. The company’s sustainability initiatives are likely to attract new investors who are keen on responsible investing.

Conclusion

In conclusion, GSK’s share price remains a crucial indicator of its operational success and future potential. Given the positive trajectory in innovative product development and careful management strategies, investors might find GSK shares an attractive option in the current market landscape. As always, potential investors are advised to conduct thorough research and consider market volatility before making investment decisions.