Current Trends in Greggs Share Price

Introduction

The share price of Greggs, a leading UK bakery chain, holds significant importance both for investors and the broader retail sector. With its unique position in the fast-food industry and a reputation for quality products, fluctuations in Greggs’ stock can provide insights into consumer behaviour and economic trends. Recently, the share price has been shaped by a blend of operational updates and changing market conditions.

Recent Performance

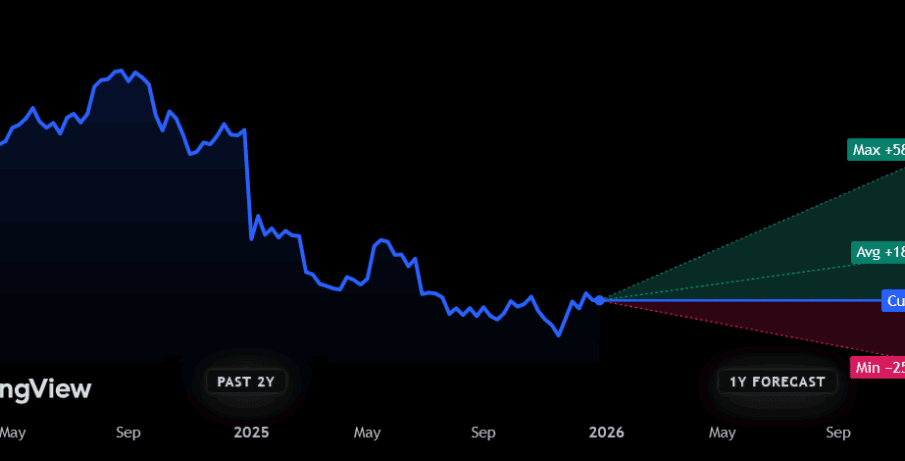

In the past month, Greggs’ share price has seen notable volatility, influenced by the company’s earnings report and the overall economic climate. As of the end of October 2023, Greggs’ share price stood at £35.50, reflecting a slight decrease of approximately 3% over the previous month. Analysts attribute this dip to the rising costs of raw materials and heightened competition within the fast-casual dining segment. Additionally, global economic uncertainties continue to put pressure on retail stock prices overall.

Operational Updates

Despite recent price fluctuations, Greggs has reported a robust performance in its quarterly earnings, with an impressive revenue growth of 10% year-on-year. The bakery chain has continued to expand its footprint across the UK, with plans to open over 100 new stores in 2024. This proactive growth strategy suggests confidence in their business model, which could lead to a recovery in share prices as investor sentiment improves.

Market Trends and Analysis

Market analysts remain cautiously optimistic about Greggs’ future as the company adapts to changing consumer preferences, such as a growing demand for healthier options and sustainable practices. The recent launch of new vegan products has been well-received and suggests a potential avenue for revenue growth. However, analysts warn that Greggs may still face challenges due to external pressures like inflation and supply chain disruptions.

Conclusion

In conclusion, while the current share price of Greggs indicates some challenges, the company’s strategic growth initiatives and positive operational performance suggest that the fundamentals remain strong. Investors should closely monitor upcoming earnings reports and market conditions as they could significantly impact the share price in the near future. The significance of Greggs’ share price extends beyond just investor interest—it acts as a bellwether for the retail sector, reflecting broader economic trends in the UK.