Current Trends in Gold Price: Analysis and Insights

The Importance of Gold Price

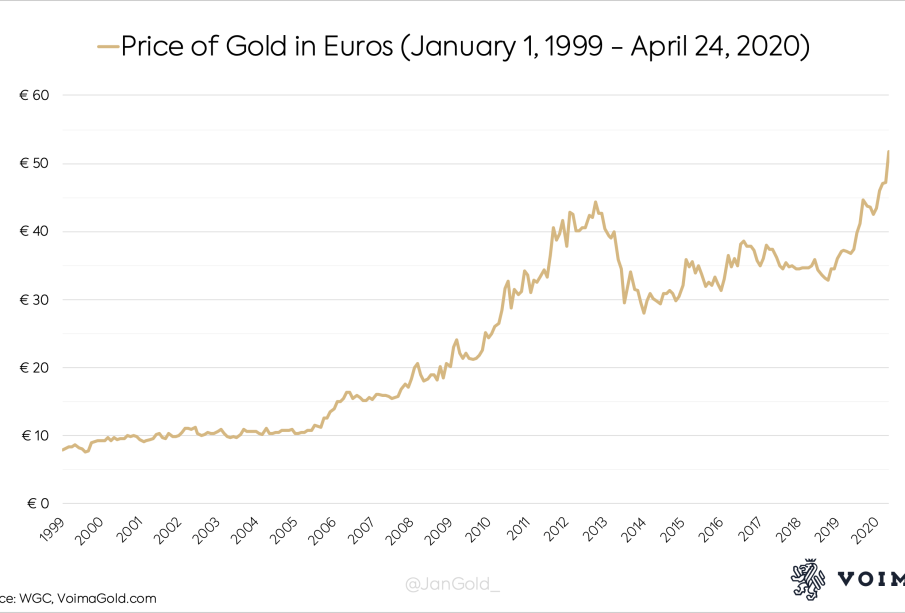

The price of gold is a significant economic indicator, influenced by numerous factors including inflation rates, currency strength, and geopolitical stability. As a traditional safe-haven asset, gold often attracts investors during times of economic uncertainty, making its price movements a topic of keen interest for economists and the general public alike.

Recent Trends in Gold Price

As of October 2023, gold prices have experienced substantial fluctuations, with current rates hovering around £1,600 per ounce. This is a notable change from the higher prices observed in early 2023, when gold reached peaks of approximately £1,800 per ounce. Analysts attribute this decline in price to a combination of stronger-than-expected economic data from the United States and a rising interest rate environment.

Central banks around the world have been reducing their gold purchases, contributing to decreased demand. Data from the World Gold Council indicates that global demand for gold fell by 11% in the second quarter of 2023 compared to the previous year. This has been primarily driven by lower investment demand and reduced jewellery fabrication.

Factors Influencing Gold Price

Several key factors are influencing the current trends in gold prices:

- Interest rates: The Bank of England’s policy decisions regarding interest rates directly impact gold prices. As interest rates rise, the opportunity cost of holding non-yielding gold increases, often leading to lower gold prices.

- Inflation: In periods of high inflation, gold is often viewed as a hedge, which can drive up demand. Recent UK inflation rates have shown some signs of stabilising, influencing investor sentiment.

- Geopolitical tensions: Ongoing global conflicts and political instability can lead to increased buying of gold as a safe-haven asset, temporarily pushing prices higher.

Future Outlook

Looking ahead, the forecast for gold prices remains mixed among analysts. Some predict a potential rally if geopolitical tensions escalate or if the economic outlook deteriorates, while others foresee continued declines should the economic recovery maintain its current pace and interest rates increase further.

Investors should remain vigilant and consider diversifying their portfolios as they watch the trends in gold prices closely. With various indicators suggesting a volatile market ahead, understanding these dynamics will be crucial for anyone interested in gold investments.

Conclusion

The gold price continues to be a pivotal element within global financial markets. As both a barometer of economic health and a safe investment during turbulent times, its fluctuations offer valuable insights into market sentiment and investor behaviour. Staying updated on gold price trends will be significant for individuals and investors alike.