Current Trends in BP Share Price and Market Insights

Introduction

The share price of BP, one of the world’s largest oil and gas companies, is a crucial barometer for investors looking to navigate the volatility of the energy sector. Understanding the factors that influence BP share price is essential for making informed investment decisions. Recent fluctuations in oil prices, geopolitical tensions, and the transition towards renewable energy sources have all played a significant role in shaping investor sentiment surrounding BP.

Recent Performance and Key Factors

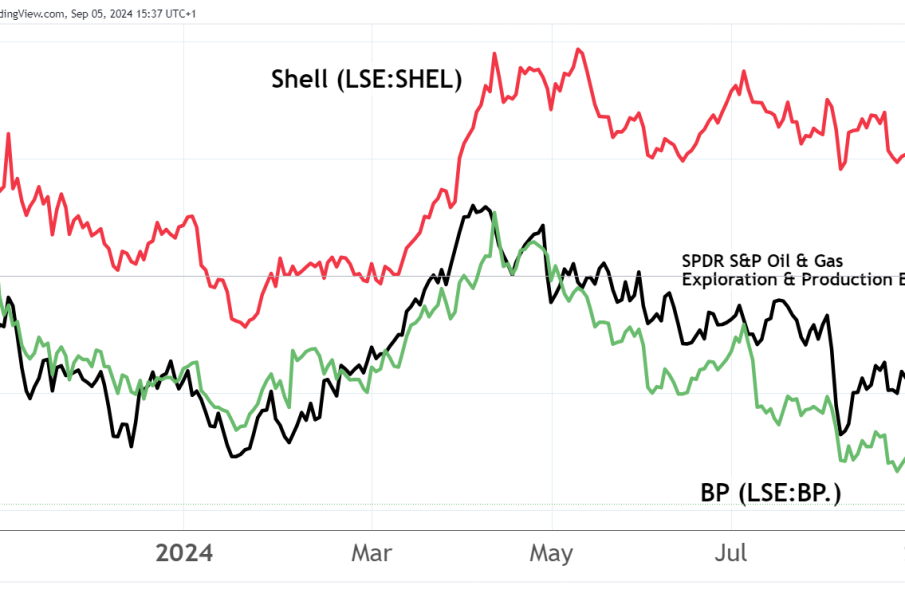

As of October 2023, BP’s share price has shown considerable volatility, reflecting a broader trend within the oil and gas market. The share price has experienced fluctuations in response to changes in global oil demand, the impact of OPEC+ production cuts, and ongoing geopolitical developments, including tensions in major crude-producing regions.

Recently, BP reported a significant increase in profits attributable to a rebound in oil prices that surged earlier this year. This recovery was largely driven by increased global demand, particularly as economies rebounded from pandemic-related restrictions. However, market analysts caution that ongoing global inflation and the rising interest rate environment could pressure BP’s shares in the coming months.

Market Predictions and Conclusions

Analysts have mixed opinions on BP’s future performance. Some predict growth as the company invests heavily in renewable energy projects and aims to achieve net-zero emissions by 2050. This transition is considered crucial not only for sustainability but also for appealing to a growing number of environmentally-conscious investors.

However, other experts caution that BP’s heavy reliance on oil and gas revenues poses risks in case of further shifts in market dynamics. The potential for increased regulation and competition in the renewable sector may also impact BP’s profitability in the future.

Conclusion

In conclusion, the BP share price remains a critical metric for investors both within and outside the energy sector. The interplay of various factors including market demand, regulatory changes, and BP’s own strategic direction will continue to shape its stock performance. As such, potential investors are advised to stay informed about these developments and consider both short-term volatility and long-term sustainability goals when evaluating BP as an investment opportunity.