Current Trends in BAE Share Price

Introduction

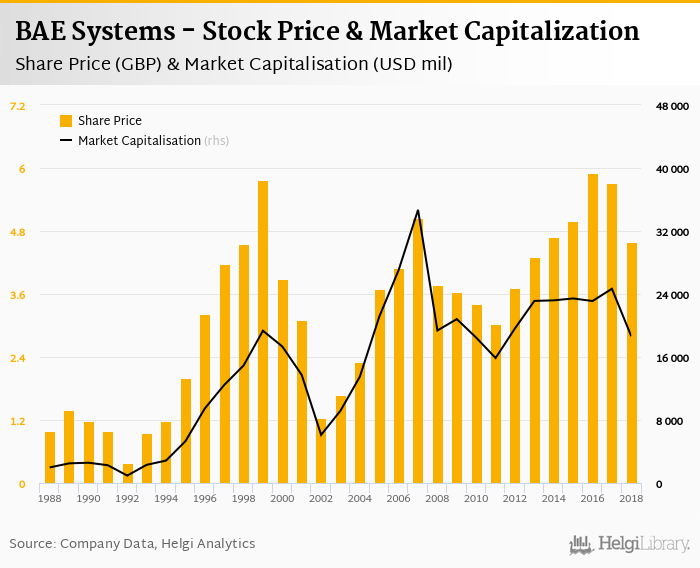

The share price of BAE Systems, a prominent global defence, security and aerospace company, is a topic of considerable interest among investors and analysts. In light of increasing global tensions and military spending, understanding the trends in BAE’s share price is more relevant than ever for stakeholders within the financial markets.

Current Performance of BAE Share Price

As of October 2023, BAE’s share price has shown a notable resilience in the face of market fluctuations. Trading around £10.56, the stock has gained approximately 12% over the past year, largely driven by robust demand for defence products and services. Recent contracts secured with the UK Ministry of Defence for advanced technology systems have bolstered investor confidence.

Factors Influencing BAE Share Price

Several factors have contributed to the current share price trajectory. A key element is the geopolitical landscape; tensions in Eastern Europe have led to increased defence budgets in several countries, spurring demand for BAE’s offerings. Furthermore, advancements in technology, especially in cyber security and drone capabilities, are paving the way for growth.

Analysts also note the potential implications of inflation and interest rates on BAE’s share performance. While rising costs can pose challenges, the company’s fixed contracts in its defence business may provide some insulation against adverse market conditions.

Market Sentiment and Projections

Market sentiment regarding BAE shares remains cautiously optimistic. Analysts foresee further growth, projecting a continuation of the upward trend in share price as new contracts are anticipated. The consensus among stock market analysts is that BAE could reach £11 within the next six months if current trends persist. This positive outlook is further supported by ongoing partnerships and collaborations within the international defence sector.

Conclusion

The BAE share price not only reflects the company’s strong business fundamentals but also the broader geopolitical and economic factors at play in the global arena. For investors, monitoring the developments in BAE Systems will be vital as they navigate potential risks and opportunities that may arise in the coming months. Keeping track of BAE’s performance can yield valuable insights for both short-term and long-term investment strategies.