Current Trends and Perspectives on BTC USD

Introduction

The BTC (Bitcoin) to USD (United States Dollar) exchange rate is a critical metric in the cryptocurrency market, reflecting not only the value of Bitcoin but also the broader economic sentiment towards cryptocurrencies. As digital currencies gain traction, understanding BTC USD fluctuations becomes increasingly essential for investors, traders, and enthusiasts alike.

Market Overview

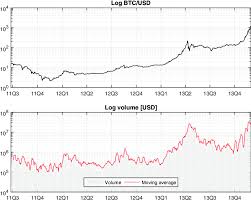

As of October 2023, Bitcoin’s price has experienced significant volatility, leading to a notable impact on the BTC USD exchange rate. Following a dramatic surge that saw Bitcoin surpass $30,000 earlier this year, the market has faced fluctuating trends, eventually stabilising around $29,000. Factors contributing to this volatility include regulatory developments, increased institutional adoption, and macroeconomic influences such as interest rate changes and inflation reports.

According to data from CoinMarketCap, Bitcoin’s market capitalisation has recently crossed the $550 billion mark, securing its position as the dominant cryptocurrency in the market. Investors are closely watching key resistance levels around $30,000 and support levels hovering near $27,000, as these will dictate short-term price movements.

Influencing Factors

Several factors are currently shaping the BTC USD landscape:

- Regulatory Environment: Recent comments from the US Securities and Exchange Commission (SEC) regarding Bitcoin ETFs have added to market speculation. The approval of a Bitcoin spot ETF is seen as a major catalyst for price appreciation.

- Institutional Investment: Large financial institutions, including major banks and investment firms, are increasingly entering the cryptocurrency space, with growing interest in Bitcoin as a hedge against inflation and a viable asset class.

- Technological Developments: Improvements in the Bitcoin network, including enhanced scalability solutions and the recent Taproot upgrade, contribute to the long-term attractiveness of Bitcoin.

Conclusion

The BTC USD exchange rate remains a vital barometer for the health of the cryptocurrency market. As Bitcoin continues to navigate regulatory landscapes, institutional interest, and macroeconomic pressures, analysts predict that BTC USD could experience further significant movements in the upcoming months. For investors and traders, understanding these dynamics is crucial for making informed decisions in a notably unpredictable environment. Moving forward, the potential for Bitcoin to reach new highs or consolidate further in its existing price range will be closely monitored by stakeholders across the financial spectrum.