Current Trends and Insights on the S&P 500

Introduction to the S&P 500

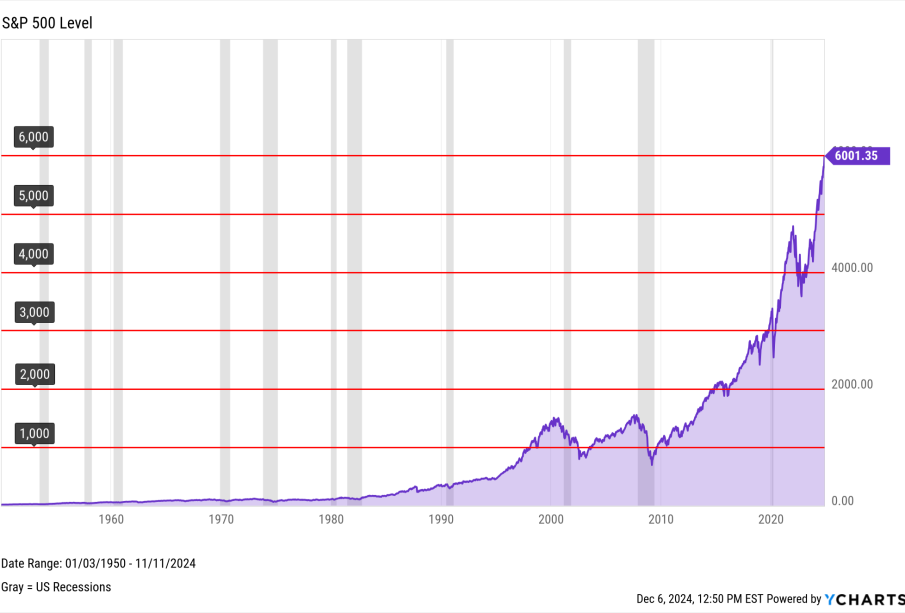

The S&P 500, or Standard & Poor’s 500, is a benchmark stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. As a leading indicator of the U.S. equities market, the S&P 500 is one of the most closely watched gauges for investor sentiment and economic health.

Current Market Trends

As of October 2023, the S&P 500 has shown a notable recovery after the complexities of the previous year. The index experienced fluctuations in response to interest rate hikes and inflationary pressures. According to recent reports, the S&P 500 has recorded a rise of approximately 15% year-to-date, reflecting a robust recovery as corporate earnings have surpassed analysts’ expectations.

The technology sector has been a primary driver of this growth, buoyed by enduring demand for cloud services and advancements in artificial intelligence. Companies such as Apple and Microsoft have had significant gains, showcasing the ongoing strength in tech-driven innovation, which remains a cornerstone of the index.

Factors Influencing the S&P 500

Several key factors contribute to the recent performance of the S&P 500. The Federal Reserve’s monetary policy plays a critical role, as it adjusts interest rates in response to inflation. Following hints of a potential pause in rate hikes, investor confidence has begun to regain strength. Moreover, geopolitical tensions and supply chain disruptions continue to shape market dynamics.

Another significant aspect is the earnings season, where companies report their quarterly earnings. Positive earnings reports have generally led to upward swings in stock prices, which in turn boost the S&P 500. Analysts remain optimistic about continued growth as many firms adjust their strategies to navigate the post-pandemic economy.

Looking Ahead

Looking forward, analysts are mixed in their outlook for the S&P 500. While there is optimism regarding earnings growth and an easing of inflation, some caution is warranted due to potential headwinds such as geopolitical conflicts and economic uncertainty globally. The upcoming elections and policy changes may also impact investor sentiment.

For investors and stakeholders, understanding the S&P 500’s moves is crucial. Engaging with market trends and economic indicators will remain essential to making informed investment decisions during this period of potential volatility.

Conclusion

The S&P 500 continues to be a pivotal element in understanding market conditions and economic health. As it approaches the end of 2023, both challenges and opportunities lie ahead. Staying informed and adaptable will be key strategies for investors aiming to navigate this landscape successfully.