Current Trends and Insights on Ørsted Share Price

Introduction

The share price of Ørsted, a leading Danish energy company renowned for its commitment to renewable energy, is a significant indicator of the company’s operational success and market position. With the global shift towards sustainable energy sources, understanding Ørsted’s share performance is relevant to investors and stakeholders who are increasingly focused on sustainable investments.

Current Share Performance

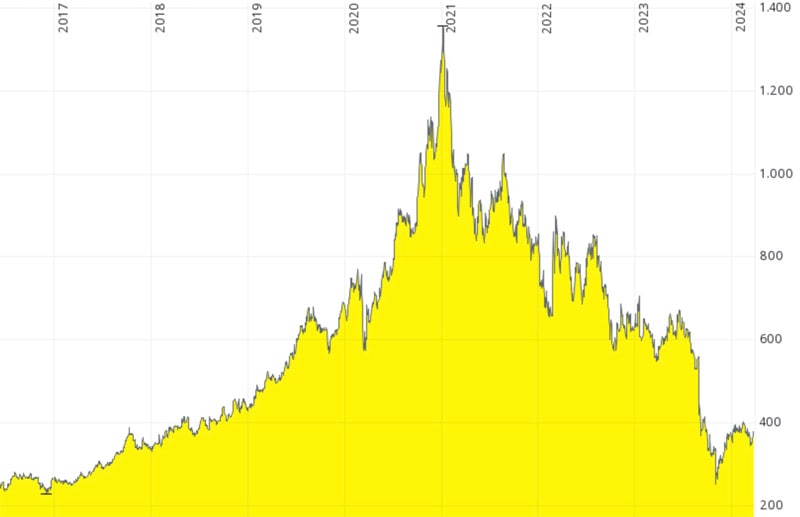

As of October 2023, Ørsted’s share price has shown considerable volatility in response to global energy market trends and regulatory changes relating to green energy initiatives. Currently, the share price is hovering around £90.00, which marks a decrease of approximately 5% over the past month. This decline is attributed to multiple factors, including rising competition in the renewable energy sector and fluctuations in electricity prices across Europe.

Market Conditions and Influences

Ørsted’s investments in offshore wind farms and solar energy projects significantly influence investor sentiment. Recent reports indicate that the company is expanding its portfolio with new offshore wind projects in the UK and the US, which are expected to operate at full capacity by 2025. However, rising costs due to inflation and supply chain disruptions have affected profitability forecasts, influencing the share price negatively.

Additionally, investor discussions regarding potential government subsidies and incentives for renewable energy developers have led to mixed reactions in the stock market. Ørsted is responsive to these political changes, with any new policies having a direct impact on its operational efficacy and investor confidence.

Future Forecast and Investor Sentiment

Looking ahead, analysts remain cautiously optimistic about Ørsted’s long-term potential. Many predict that as the world continues to adapt to climate change and embrace cleaner energy solutions, the share price could rebound significantly. Several financial institutions have set a price target of £100 within the next 12 months, citing Ørsted’s robust project pipeline and strategic investments in energy infrastructure.

Moreover, Ørsted’s commitment to sustainability and innovation positions it well to benefit from increasing governmental and corporate support for green technologies, alleviating some of the pressures observed in the current market. Investors are advised to keep an eye on quarterly earnings reports and project announcements for any substantial shifts in share performance.

Conclusion

The Ørsted share price remains a focal point for those interested in the renewable energy sector. Despite current fluctuations, the company’s strategic initiatives and alignment with global sustainability goals could signal positive long-term performance. As Ørsted continues to lead in the renewable energy transition, investors are urged to consider both short-term market dynamics and long-term growth potential in their investment strategies.