Current Trends and Impacts of Inflation in the Economy

The Importance of Understanding Inflation

Inflation, the rate at which the general level of prices for goods and services rises, is a critical economic indicator that directly influences everyday life. As the cost of living continues to surge, understanding inflation has never been more relevant for consumers and policymakers alike. Tracking inflation trends is essential for making informed financial decisions, from personal budgeting to investment strategies.

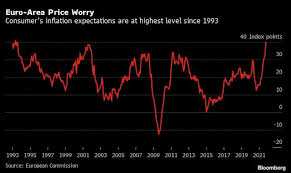

Current Inflation Trends

As of late 2023, inflation rates in the UK continue to be a major concern, following a peak earlier this year. The Office for National Statistics reported an inflation rate of 4.9% in September, a decrease from 10.1% in July 2022. This decline is mainly attributed to easing energy prices and supply chain disruptions post-COVID-19. However, inflation remains above the Bank of England’s target of 2%, contributing to rising costs for consumers and businesses alike.

Causes of Inflation

Several factors contribute to inflation, including demand-pull inflation, where demand outstrips supply, and cost-push inflation, where production costs rise. In the current climate, increased consumer demand following the pandemic, coupled with ongoing supply chain issues, has heightened inflationary pressures. Additionally, global events such as geopolitical tensions and climate-related disruptions further exacerbate these issues.

Impact on Consumers and Businesses

For consumers, persistent inflation erodes purchasing power, making it increasingly challenging to afford everyday necessities such as food, housing, and transportation. For businesses, rising operational costs can lead to increased prices for goods and services, potentially slowing down consumer spending. This, in turn, can create a challenging environment for economic growth and employment.

Looking Ahead: Future Projections

Economists have mixed forecasts for inflation in 2024. Some predict a further decline in rates due to easing supply constraints, while others warn of potential upward pressures from wage increases and higher energy costs. The Bank of England remains vigilant, adjusting monetary policy to ensure inflation targets are met while supporting economic recovery.

Conclusion

Understanding inflation is crucial for navigating the current economic landscape. As consumers face rising costs, it is essential to keep informed about inflation trends and their ramifications. Policymakers will continue to monitor these dynamics closely, aiming to strike a balance between fostering growth and maintaining price stability.