Current Trends and Analysis of HSBC Share Price

Importance of HSBC Share Price

The share price of HSBC Holdings plc, a leading multinational bank, is a significant indicator of not only the company’s financial health but also the broader economic conditions impacting global banking. Understanding the factors that influence the HSBC share price can help investors make informed decisions, especially in the current economic climate marked by fluctuating interest rates and geopolitical tensions.

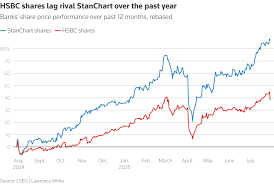

Current Performance and Trends

As of mid-October 2023, HSBC’s share price is facing fluctuations due to various economic factors. Following a steady increase over the past year, the share price recently found resistance at around £4.80. Analysts attribute this to rising interest rates implemented by central banks worldwide, which could potentially enhance profit margins for banks but also presents risks associated with increased defaults in loan repayments.

Shares of HSBC have been trading in a range between £4.50 and £5.00, suggesting investor indecision amid global market volatility. The firm announced its latest quarterly results last month, which showed a revenue increase, but these gains were tempered by concerns over loan quality due to rising rates in numerous markets, especially in Asia, where HSBC derives a substantial part of its income.

Global Economic Factors

Additionally, HSBC’s international exposure means it is highly sensitive to geopolitical developments. In October, the ongoing conflict in the Middle East has led to instability affecting market sentiments. Furthermore, the potential for a recession in major economies presents challenges that investors should closely monitor as they can have a direct correlation with the share price.

The UK banking sector is also responding to the Bank of England’s continued monetary policy tightening, which has introduced additional uncertainty regarding future earnings for banks like HSBC.

Conclusion and Future Outlook

In conclusion, while HSBC’s share price is currently influenced by a mix of ongoing economic shifts and unexpected global factors, the longer-term outlook remains cautiously optimistic among analysts. With a solid dividend yield and significant international operations, HSBC may navigate these challenges effectively.

Investors are advised to keep an eye on upcoming earnings reports and global economic indicators, as these will likely play a pivotal role in shaping the future trajectory of HSBC’s share price. It highlights the importance of integrating macroeconomic analysis into investment strategies when dealing with large multinational banks.